- The upcoming Shanghai Upgrade for Ethereum generates interest, but scrutiny may harm ETH’s future.

- The founder of Cobo warns private keys of staked ETH addresses may be vulnerable.

- Validators still support the upgrade, and traders show positive sentiments toward ETH.

The upcoming Shanghai Upgrade for Ethereum is generating interest in the crypto community, but increased scrutiny may harm the future of ETH. The founder of Cobo has warned that private keys of staked ETH addresses may be vulnerable to exposure.

According to Shenyu, the founder of Cobo, a digital asset custody service provider, the private keys of Ethereum addresses that have staked their ETH may be at risk of exposure. This news comes as a concern to the community, and steps may need to be taken to mitigate the potential damage.

To mitigate the risk of private key exposure, the founder of Cobo recommends that centralized staking providers assess their private key storage methods, evaluate the status of authorized personnel, and establish contingency plans. This could help prevent potential damage to the Ethereum community.

Moreover, Shenyu has advised caution by citing a similar incident during the launch of Arbitrum’s AirDrop, where multiple private keys were exposed. This further highlights the importance of taking preventative measures to safeguard private keys and prevent potential damage to the Ethereum community.

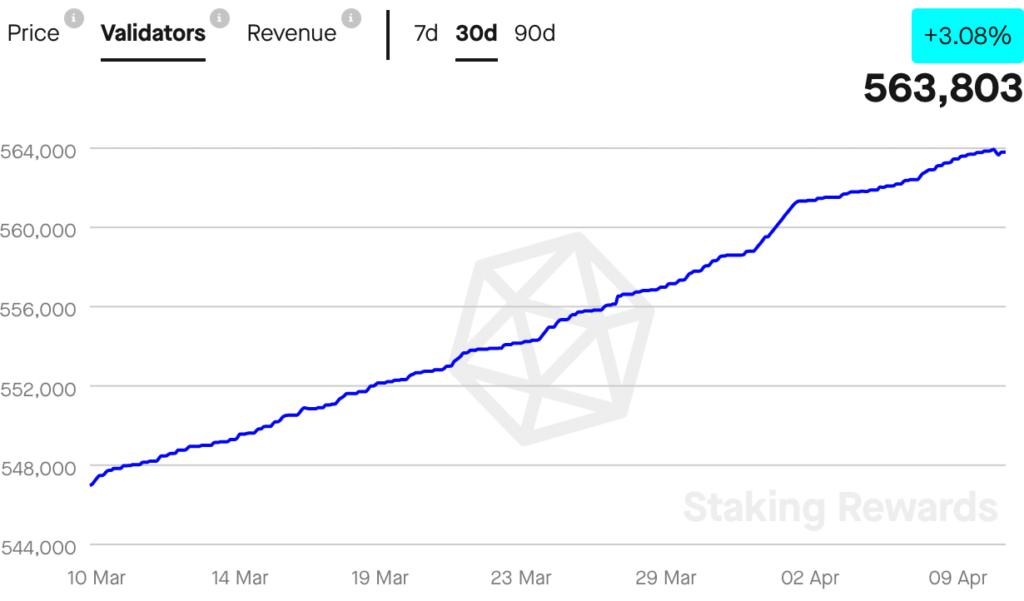

Despite the growing concerns, validators on the Ethereum network are still supporting the upcoming upgrade. According to data from Staking Rewards, the number of validators on the network has increased by 3.08% in the past 30 days.

As of now, there are 563,803 validators on the Ethereum network, collectively earning $2.34 billion in revenue. This suggests that the community remains confident in the future of Ethereum, despite the potential risks associated with the Shanghai Upgrade.

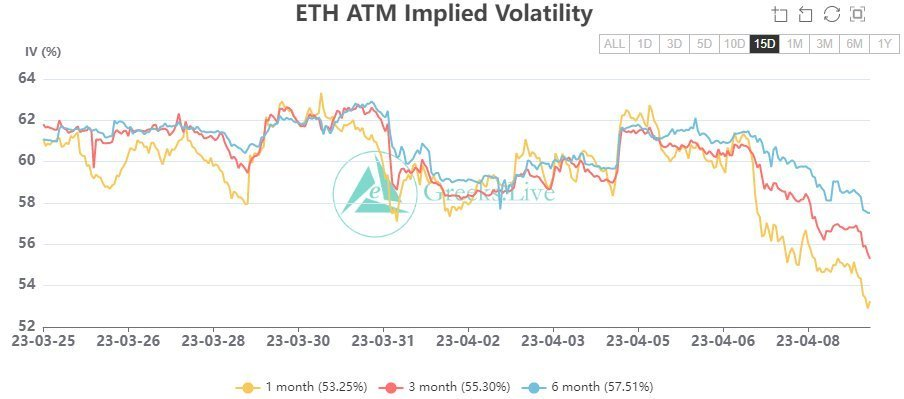

Additionally, Traders are also showing a positive sentiment toward ETH, possibly due to the decrease in Ethereum options’ implied volatility (IV). According to Greeks Live, the IV for Ethereum has decreased by 8% in the past two weeks. A drop in IV for Ethereum suggests that the market views the price of Ethereum as less risky and uncertain.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.