- Investors should prepare themselves for a disappointing Q4 from Binance Coin.

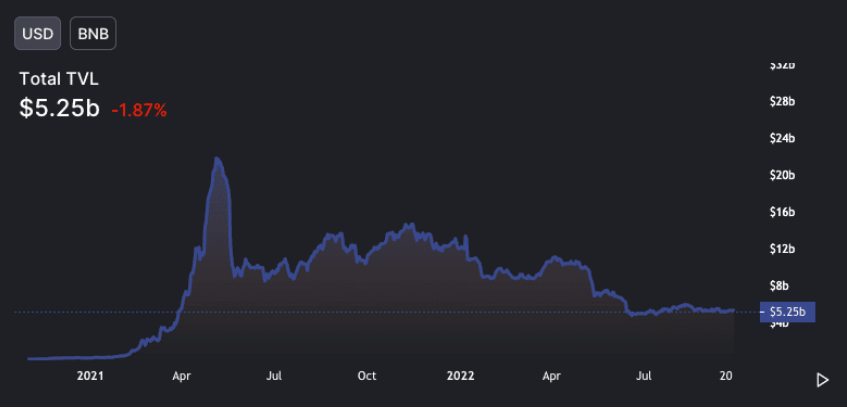

- BNB’s TVL is down 1.87% from yesterday.

- Technical indicators suggest the momentum of BNB is currently bearish.

Analysts believe that investors should prepare themselves for a disappointing Q4 from Binance Coin (BNB). This comes despite the fact that the currency performed rather well on some fronts.

According to data from BNBburn, the number of tokens burned in Q3 surpassed the entire record for Q2 of this year. The Q3 total of burned tokens now stands at about 2,040,503.56 BNB. The number of tokens that were burned in Q2 was 1,976,739.87.

Despite the dramatic increase in the BNB burn rate, the crypto is still in need of some help. As of today, data from DeFI Llama indicates that BNB’s Total Value Locked (TVL) on the Binance Smart Chain is worth less than it was on September 27. At the time of writing, BNB’s TVL stood at around $5.25 billion. This is a 1.87% drop since yesterday.

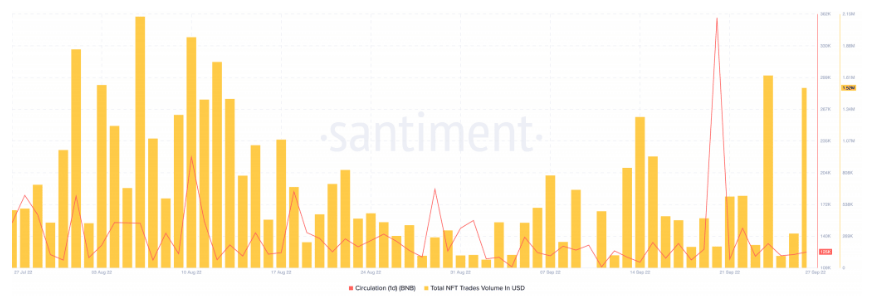

In addition to this, the crypto’s one-day circulation is not impressive at the moment. Data from the financial analysis firm, Santiment, indicates that the uptick on the one-day circulation that was seen on September 20 fell from 358,000 to 125,000.

On the bright side, things looked better for BNB on the NFT side. At the time of writing, the BNB NFT trades stood at $1.52 million.

When looking at a few of the crypto’s technical indicators, things are not looking too well. The BNB’s Awesome Oscillator (AO) indicates that the momentum for the crypto is currently bearish.

The same can be said when looking at the Relative Strength Index (RSI) for BNB. According to the 4-hour chart, the RSI has an increasing gradient that is almost reaching 50.

BNB is currently trading at $284.11 after a 5.22% increase in price over the last day.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.