- Quant price today trades near $98 after rejection above $100 and $105 supply zone.

- Breakout above major trendline shifts structure bullish while outflows show profit taking.

- Holding above $94–$95 keeps upside toward $120 alive while failure risks drop into $80 region.

Quant price today trades near $98 after failing to hold above the key psychological level at $100 following a breakout from a multi-month descending trendline. The move marks the first clear technical shift in months, but the rejection has forced buyers to defend higher lows while spot flows remain negative.

Breakout Sparks Structural Shift In The Daily Trend

The daily chart confirms a decisive break of the descending resistance line that dominated price action since Q2. The breakout followed a strong rally from the $70 zone, flipping sentiment short term and turning prior resistance into a potential support area.

Quant now trades above all major moving averages:

- 20-day EMA near $87.93

- 50-day EMA near $86.94

- 100-day EMA near $90.73

- 200-day EMA near $94.03

The reclaim of this cluster is significant because QNT spent most of the prior quarter trading below it. Reclaiming all EMAs in a single impulse rally is usually a bullish sign, but continuation requires a successful retest.

The rejection near $110 shows that sellers still control overhead liquidity. Every attempt above $105 has been met with supply, leaving a narrow window for bulls. Price now sits in a zone where buyers need to step in to avoid turning the breakout into a failed attempt.

Two Hour Chart Shows Narrow Channel Uptrend With Slowing Momentum

Shorter timeframes show Quant consolidating inside a rising channel after the breakout. The two hour structure remains orderly but shows visible loss of momentum.

The Supertrend sits overhead at $103, acting as immediate resistance, while the upper channel line has rejected price repeatedly. The Parabolic SAR has flipped above price during pullbacks, signaling slowing momentum inside the channel.

The lower boundary of the channel currently sits near $95, and that level becomes the first support for intraday traders to defend. A close below that line exposes a deeper pullback toward the 20-day EMA cluster near $90-$94. Holding above the lower channel keeps the structure intact and preserves the potential for another retest of $105-$110.

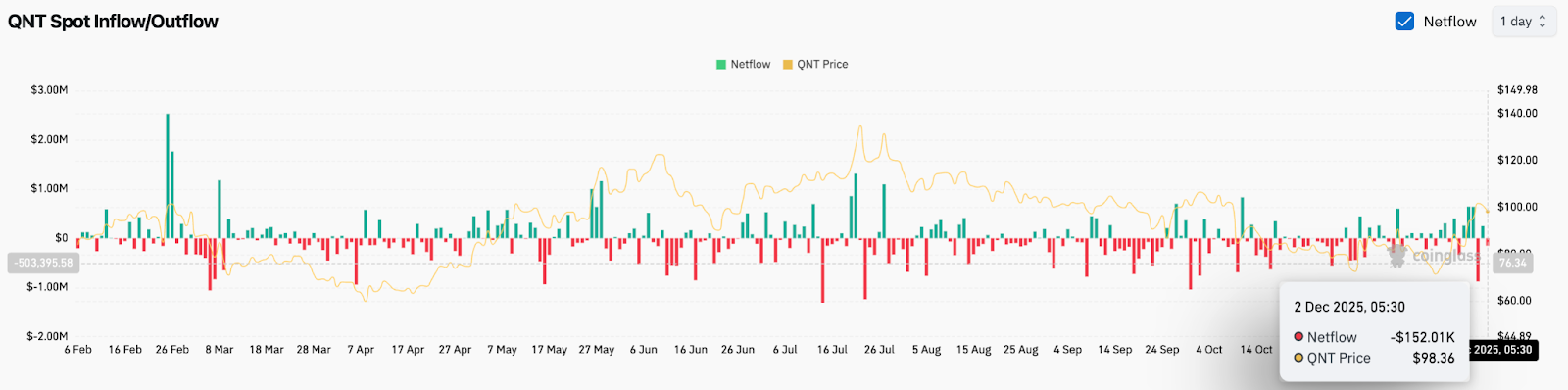

Spot Outflows Show Early Profit Taking

Coinglass data recorded $152,000 in net outflows on December 2, continuing a trend of modest but persistent selling.

While not large compared to the market cap, the behavior reflects distribution rather than accumulation. The flows also coincide with the rejection at $110, suggesting holders used strength to exit positions rather than increase exposure.

Over the past year, Quant has shown a tendency for outflows to accelerate near local peaks, and inflows to dominate during value accumulation. The current flow pattern sits between those extremes: not a panic exit, but not aggressive positioning either.

Outlook. Will Quant Go Up?

Quant remains in a constructive structure after a major breakout, but buyers must prove they can sustain momentum.

The bullish case remains intact as long as price holds above $94-$95 and reclaims $105 with rising volume. That move would signal strength behind the breakout and create a path toward $120-$125.

The bearish case emerges if price loses the channel and closes below $94-$90, which would turn the rally into a failed breakout and expose downside risk toward $80-$70.

If buyers reclaim the initiative above resistance, the trend expands. If they fail to defend higher support, the market treats the move as a reaction rather than a reversal.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.