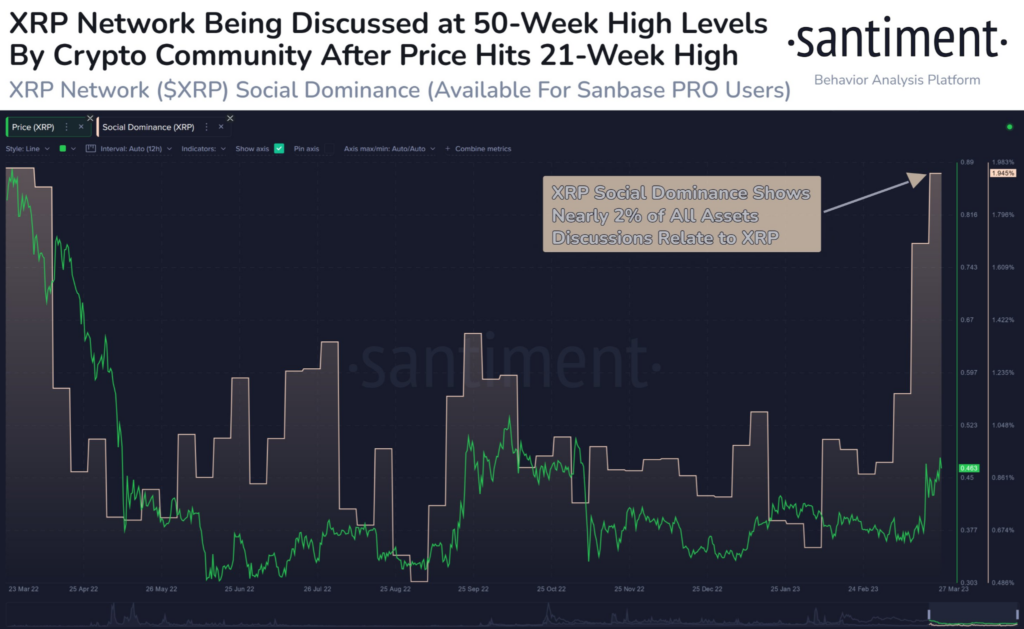

- Santiment recently tweeted that XRP’s social dominance is at a yearly high.

- The rise in XRP’s social dominance comes after the altcoin’s price broke above $0.49.

- In related news, XRP and ADA are the only top 10 cryptos with 24-hour gains.

The blockchain analysis firm Santiment (@santimentfeed) tweeted yesterday that social dominance for Ripple (XRP) is at its highest point in a year. The tweet added that this spike in Ripple’s social dominance came after the remittance token’s price comfortably broke above $0.49 for the first time since 6 November 2022.

Santiment’s tweet did warn, however, that this additional crowd recognition for XRP may result in more volatile price swings for the altcoin due to increased trading volume and growing mainstream interest.

At press time, XRP’s price is up 4.76% over the last 24 hours according to CoinMarketCap. This has added to the altcoin’s impressive weekly price performance which currently stands at +25.44%. As a result, XRP is currently changing hands at $0.4854.

XRP has also made its way onto CoinMarketCap’s trending list and occupies the number 2 spot currently. Meanwhile, the altcoin’s 24-hour gain is an outlier in the market given that the total crypto market cap fell by 2.22% in the last 24 hours. This has brought the global crypto market cap down to around $1.13 trillion.

Almost all of the top 10 cryptos in terms of market cap posted losses over the last 24 hours. This is also true for the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH), which saw their prices drop by 3.02% and 1.54% respectively. As a result, BTC’s price stands at $26,978.84 and ETH is trading at $1,725.73 at press time.

The only other crypto in the top 10 list which saw its price increase in the last 24 hours is Cardano (ADA), which is currently up 0.26% to trade at $0.3496.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.