- Crypto trader Ali recently retweeted an old thread regarding the BTC halving.

- The tweet suggests that the market is currently in a BTC accumulation phase.

- In related news, the price of BTC is trading at $30,731.20 after a 1.37% increase.

Renowned crypto trader Ali (@ali_charts) retweeted an old thread this morning which related to the upcoming Bitcoin (BTC) halving and the various market phases that accompany the significant event.

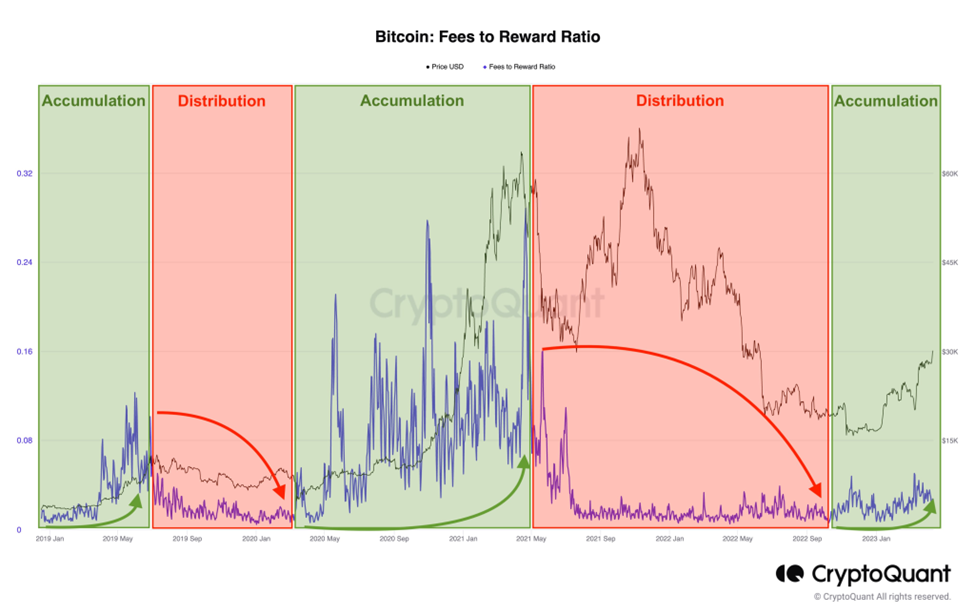

According to the retweeted thread, the recent spike in the fees-to-rewards ratio suggests that the market has entered into an accumulation cycle recently – similar to the one in 2019 and 2020. The thread added that this is an indication of a potential price rally for BTC leading up to the 2024 halving.

At press time, the market leader’s price stands at $30,731.20 after a 1.37% increase over the last 24 hours according to CoinMarketCap. The 24-hour gain has added to BTC’s positive weekly performance – pushing the total weekly gain to 10.25% at press time.

Despite BTC’s positive price movement recently, BTC was still outperformed by the altcoin market. Currently, BTC’s market dominance is estimated to be 46.41%, which is 0.56% lower compared to what its dominance was yesterday. The altcoin leader, ETH, was also able to outperform BTC over the last 24 hours and, as a result, is up around 4.60% against BTC.

Technical indicators on BTC’s daily chart are bullish at press time. Currently, the 9-day EMA is trading above the 20-day EMA. In addition to this, the daily RSI line is trading above the daily RSI SMA line. BTC’s daily RSI line is also sloped positively towards overbought territory, which is another positive sign for the market leader’s price.

These technical indicators suggest that BTC’s price has entered into a medium-term bullish cycle and may continue to rise in the next 24-48 hours. Should this bullish thesis be validated, BTC’s price could soar to the next resistance level at around $36,900.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.