- Brad Garlinghouse addresses SEC Chair Gary Gensler as a political liability.

- The CEO asserts the necessity of a new SEC chair, pointing out Gensler’s lack of consideration for citizens’ interests.

- Mr. Huber shares a sarcastic comment about Gensler, reflecting on his alleged interest in banks.

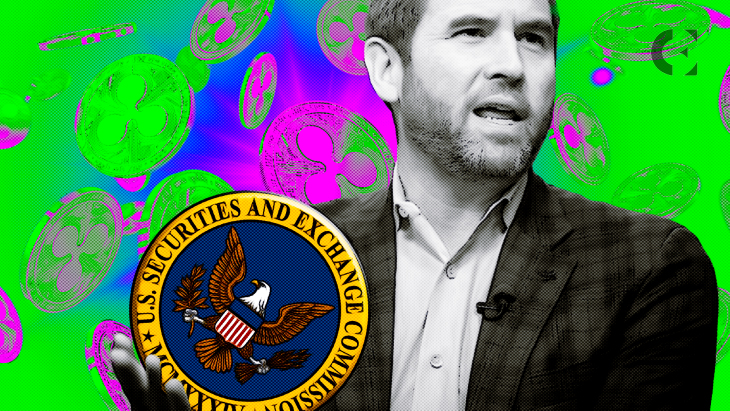

Brad Garlinghouse, the CEO of Ripple, recently shared his discontent with SEC Chair Gary Gensler’s regulatory policies, addressing him as a “political liability.” In light of multiple lawsuits against prominent crypto firms as well as the rejection and delays in Spot Bitcoin ETF approval, Garlinghouse pointed out the necessity of a new SEC Chair.

Ripple has been fighting against the SEC’s allegations of offering unregistered securities since 2020. Despite a landmark victory in July 2023, when U.S. District Judge Analisa Torres ruled XRP as a non-security, the protracted SEC-Ripple lawsuit hasn’t reached a conclusion yet. Reflecting on Gensler’s legal war against crypto firms, including Ripple, in spite of repeated failures in court, Garlinghouse cited:

One of the definitions of insanity is doing the same thing over and over again and expecting a different outcome…I think Gary Gensler is doing the same thing over and over again, and he thinks that somehow he’s going to win in court. He has continued to lose in court.

In addition, Garlinghouse asserted that Gensler does not consider the interests of the citizens or the long-term growth of the economy. Shedding light on the United States’ need for a new SEC chair, he stated, “I think at some point there will be a new chair of the SEC, and I think that will be a good thing for the American people.

”Responding to Garlinghouse’s tweet, the XRP advocate, Mr. Huber, shared a sarcastic comment against the SEC Chair, reflecting on his alleged favor for banks. Mr. Huber wrote, “Maybe you have to give 50% of your ownership to the 20 banks that are now part of this.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.