- Ripple CTO invited Custodia Bank CEO to a discussion following her criticism of XRP Ledger and Ripple’s stablecoin RLUSD.

- Caitlin Long claimed that XRPL is centralized and banks distrust it.

- Community members refuted this, stressing the ledger’s decentralization and Ripple’s non-ICO origin.

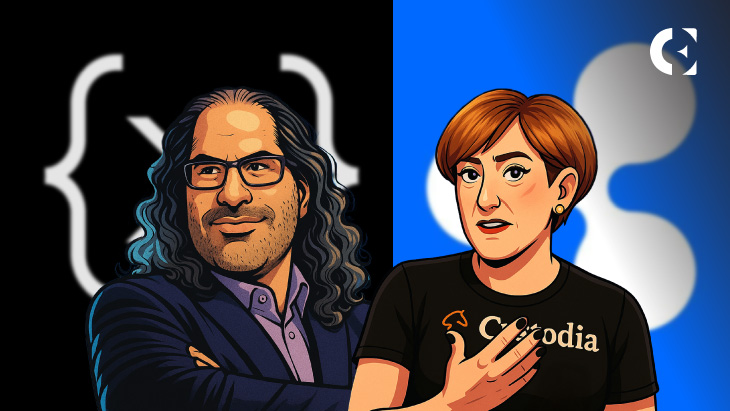

Ripple’s Chief Technology Officer, David Schwartz, has publicly invited Custodia Bank CEO Caitlin Long for a fact-based discussion regarding XRP, the XRP Ledger (XRPL), and Ripple’s stablecoin RLUSD.

Caitlin Long Challenges XRP Ledger’s Integrity

During a recent appearance on the Gold Goats ‘n Guns podcast, Caitlin Long delivered a critical take on Ripple and its ecosystem. She questioned XRPL’s decentralization, alleging that banks remain wary of XRP’ Ledger’s architecture and have largely distanced themselves from the network.

Long also argued that Ripple’s early fundraising efforts resembled an ICO, a move she believes damaged institutional trust.

In contrast, she claimed that Bitcoin and Ethereum raised relatively modest sums at launch. She further asserted that XRPL has not demonstrated meaningful evolution since its inception. Her comments arrived at a time when Ripple is actively pursuing a National Bank Charter and access to a Federal Reserve master account to support RLUSD.

According to Long, this strategic shift signals an internal admission that XRPL won’t become a true SWIFT replacement.

She predicted that in any U.S. Treasury initiative to tokenize T-Bills, Ethereum would be the favored platform due to its permissionless and mature infrastructure.

Schwartz’s Response: “Let’s Discuss the Facts”

In response, members of the XRP community pushed back on Long’s assertions. David Schwartz stepped in, proposing a dialogue based on verifiable facts about Ripple’s technologies and roadmap.

“I’m available to discuss the facts about Ripple, RLUSD, the XRP Ledger, and XRP,” Schwartz posted.

Schwartz also drew attention to a thread by well-known XRP community contributor, Vet, who debunked several of Long’s statements.

Walking the Walk: Schwartz isn’t just talking about decentralization. CoinEdition previously reported on how he launched his own independent XRPL server.

Community Defends XRP’s Legacy and Structure

Vet clarified that Ripple did not conduct an ICO. Instead, the full supply of 100 billion XRP was generated at launch and deposited into a genesis account, distinguishing its origins from Ethereum’s token sale, where investors exchanged Bitcoin for ETH.

Addressing the centralization narrative, Vet highlighted that the XRP Ledger operates with a decentralized validator model, with some individuals independently running as many as 1,000 nodes.

He also noted that Ripple actively builds on XRPL, including deploying RLUSD directly on the ledger. Vet emphasized the ledger’s evolution over the years, pointing to ongoing technical upgrades and amendments that have enhanced its capabilities.

Another prominent voice, Mickle, echoed these points. He highlighted that XRPL existed before XRP was publicly sold and reminded that Ethereum holds the record for launching the first-ever ICO.

While many in the XRP community have pushed back against Long’s stance, her criticisms are not isolated. They align with sentiments shared by others in the crypto industry, including Ethereum co-founder Vitalik Buterin.

Why this debate now? Long isn’t the only one with this view. Here’s our earlier report on when El Salvador’s Bitcoin advisor made a similar claim.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.