- Sentiments are a powerful driving force in crypto market moves, report Santiment.

- The platform confirms high buy calls correspond to price declines, while high sell calls correspond to price increases.

- Traders can provide valuable insights for identifying market trends via terms like FOMO and FUD.

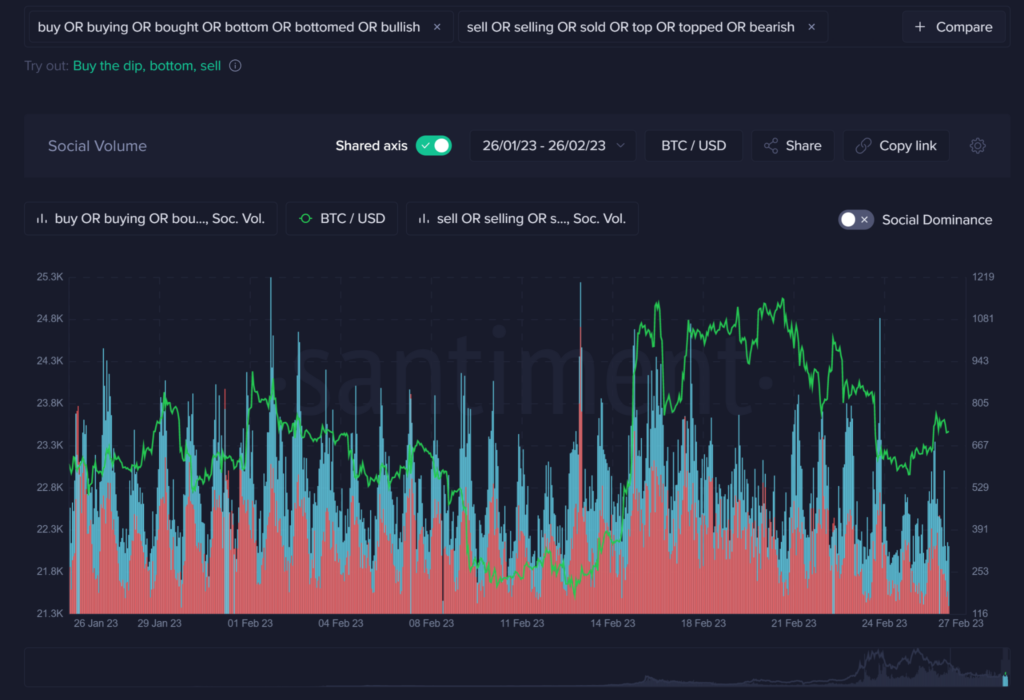

Crypto analytics platform Santiment published a report on how the crypto markets react to FOMO versus FUD meta mentions. According to their insights, “sentiment really is the most powerful driving force in terms of the next big move.”

Since the start of 2023, the markets have experienced increased openness, reported Santiment. The crypto analytics platform also notes the extent of fluctuation as the trading community discusses that prices have remained within the range of $20,000 and $25,000, for approximately five weeks.

Notably, surges in either price level frequently lead to indicators of a shift in price direction, according to Santiment.

Moreover, during price drops, it is expected to observe traders predicting the bottom formation and calling for prices to reach $20,000. Conversely, as prices approach $25,000 during an upward trend, it is common to observe more mentions of a potential market top forming.

Santiment shared that high levels of buy calls typically correspond to price declines, while high levels of sell calls correspond to price increases.

As per Santiment, traders often use terms such as FOMO (fear of missing out) and FUD (fear, uncertainty, doubt) to mock weak traders who succumb to prevailing trends. For instance, during the sharp price decline around February 13th, traders pointed out the prevalence of FUD among others.

However, these terms can also serve as true indicators. A surge in FOMO often coincides with price tops. Conversely, red bars indicating a rise in FUD tend to signal a higher probability of an upcoming price increase. In essence, traders unwittingly provide valuable insights for identifying market trends.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.