- SEC approves Ethereum spot ETF options providing new trading opportunities for investors.

- Position limit set at 25,000 contracts reduces market manipulation risk for Ethereum.

- Ethereum price jumps 13% in 24 hours fueled by positive market news.

The U.S. Securities and Exchange Commission (SEC) has officially approved options trading on spot Ethereum ETFs—a move similar to what it previously did for Bitcoin spot ETFs.

What Does ETH ETF Options Approval Mean?

This approval allows financial institutions to create and list options contracts tied to spot Ethereum ETFs, giving investors more ways to hedge their positions or speculate on Ethereum’s price movements within a regulated U.S. framework.

One of the key updates in the approved filing is a position and exercise limit set at 25,000 contracts per investor, on exchanges like Nasdaq ISE. This relatively conservative limit is to balance market stability concerns with investor access, reducing manipulation risk while still allowing significant trading.

Related: ‘Buy Stocks’ Says Trump, ‘Bad Advice’ Says Schiff: Who’s Right on Tariffs?

The exchange pointed to ETH’s trading activity and wide investor base as supporting evidence for listing options. As of late 2024, the trust had more than 93,000 shareholders, a market cap exceeding $1.1 billion, and an average daily trading volume (ADV) of over 5.3 million shares.

How Did Ethereum’s Price React?

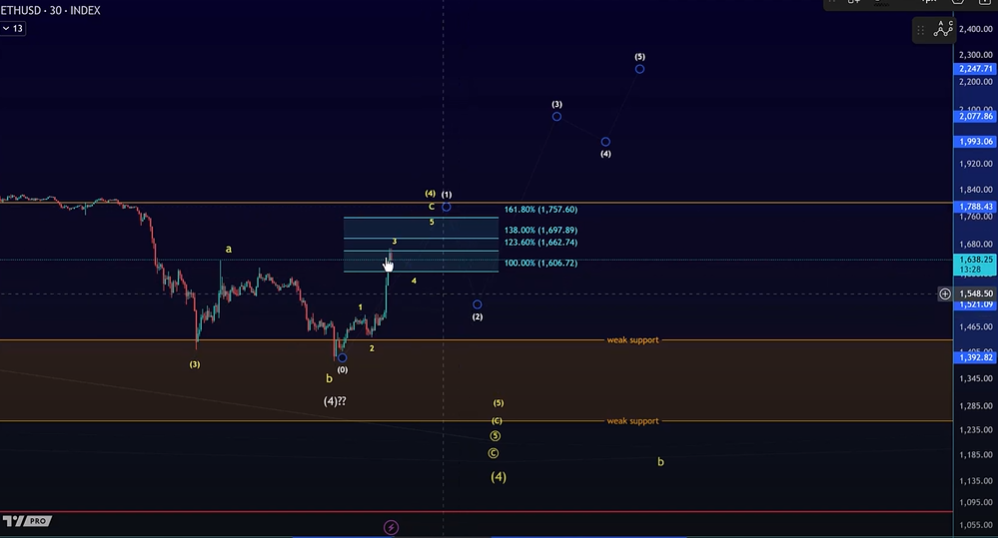

Ethereum saw a positive price reaction, gaining 13% in the last 24 hours, with the price now trading close to $1600. This rally appears linked to both the positive news of the SEC’s options approval and broader market relief following President Trump’s temporary 90-day pause on tariffs. These combined factors contributed to improved market sentiment recently.

While the rally pushed ETH past some previous resistance, technical hurdles remain.

Related: Trump’s 90-Day Tariff Pause Can’t Shake Polymarket’s 65% Recession Odds

Key resistance levels to watch now include $1697 and $1788. The primary support zone appears to be between $1550 and $1611 (near the recent lows). Analysts suggest that holding above this support is crucial for Ethereum to potentially make a run towards the significant $2000 mark.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.