- SEC Commissioner criticizes the agency’s new approach to crypto regulations.

- Peirce argues that the proposed rule has no evidence that investors will benefit.

- The crypto industry supports Peirce’s stance, with Coinbase CLO thanking her.

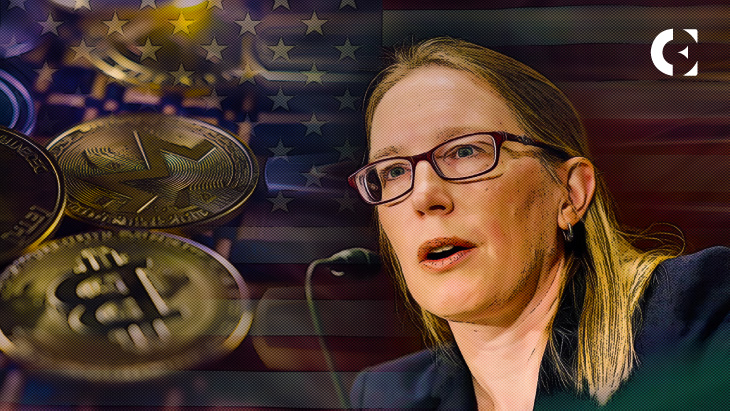

Hester Peirce, the Commissioner of the US Securities and Exchange Commission (SEC), has criticized the agency’s new approach to crypto regulations, which included expanding the definition of “exchange.”

Peirce described the Commission in her statement on amending the definition of exchange as “aggressive in expanding its regulatory reach to solve problems that do not exist.” The commissioner argued that the proposed rule would stretch the statutory definition of “exchange” beyond a reasonable reading and has no evidence that investors will benefit.

Peirce’s criticisms come when the SEC faces increasing pressure to clarify its regulatory stance on crypto and decentralized finance (DeFi) platforms. Last week, the SEC reopened a comment period to seek further input on its proposed rulemaking that would expand the definition of “exchange” to include new forms of DeFi platforms.

However, Peirce lamented the SEC’s insistence on forcing entrepreneurs trying to introduce new technologies to register their projects, even if they do not fit into the SEC’s regulatory framework. She contrasted the current approach to the one the Commission adopted 30 years ago when it faced a similar challenge with alternative trading systems. In her words:

Rather than embracing the promise of new technology as we have done in the past, here we propose to embrace stagnation, force centralization, urge expatriation, and welcome extinction of new technology.

In a conversation on Twitter, the Chief Legal Officer of the Coinbase crypto exchange thanked Peirce for her defense of the crypto industry. “In just 60-something words,” Grewal wrote, “SEC Commissioner has managed to articulate all that hits awfully close to home.”

Notably, the SEC has brought several high-profile cases against crypto projects, including Ripple Labs, for allegedly violating securities laws.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.