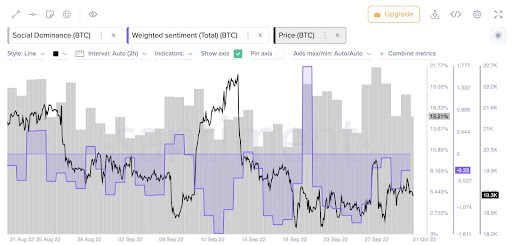

- Data from Santiment shows that sentiment for BTC remains negative.

- Santiment’s social data shows that BTC’s weighted sentiment score is -0.33.

- The price of BTC is currently resting on the daily 9 EMA line.

Recent data from the blockchain analysis firm, Santiment, indicates that the market sentiment towards the crypto market leader, Bitcoin (BTC), remains negative. According to social data published by Santiment, the weighted sentiment score for BTC is around -0.33.

Meanwhile, talk of BTC on social media platforms sits way below 20%, which is indicative of a waned interest for the crypto market king.

At the time of writing, BTC is trading at $19,268.58 after its price dropped by a slight margin of 0.20% over the last 24 hours. This is according to the crypto market tracking website, CoinMarketCap. Nevertheless, BTC’s price is still up 0.89% for the week. As such, its market cap now stands at around $369,503,662,852.

BTC’s 24-hour trading volume has also fallen over the last 24 hours by 55.16% to take the total to $17,855,504,337.

Its price is currently trading closer to its 24-hour low of $19,231.08 and was able to set a daily high at $19,370.31.

Looking at the daily chart for BTC/USDT, the price of BTC is currently resting on the 9 Exponential Moving Average (EMA) line. This may not last long, however, as the sell volume that has entered the market over the last 24 hours suggests that bears are attempting to sink BTC’s price below this level.

Bears have the upper hand at the moment as the 20 EMA line is positioned below the shorter 9 EMA line, which further suggests that the crypto market leader is currently in a bear cycle.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.