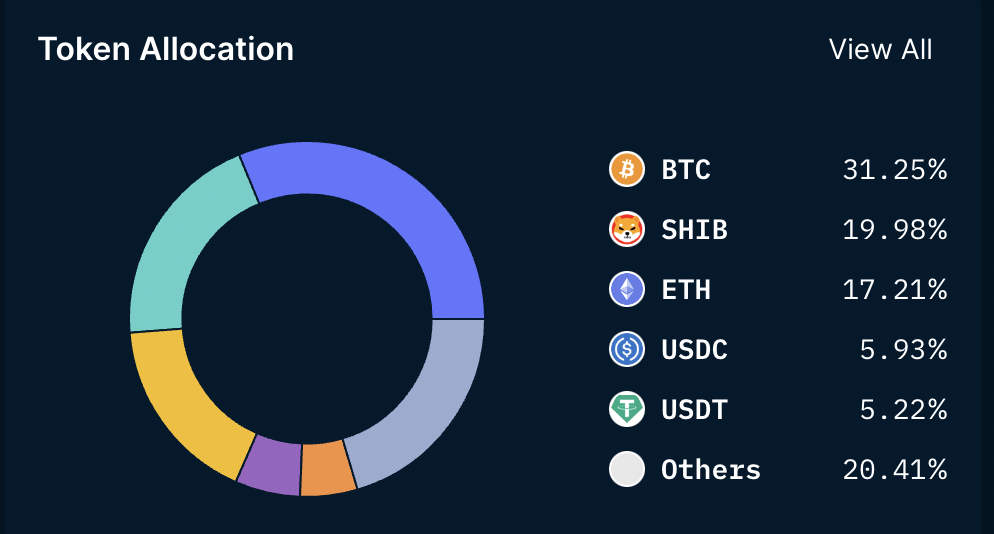

- Crypto.com’s largest portfolio allocations include ETH, BTC and SHIB.

- SHIB is the exchange’s second largest reserve holdings.

- In related news, the price of CRO has dropped 13% over the last 24 hours.

The founder and CEO of the crypto exchange, Crypto.com, Kris Marszalek, released a dashboard of the exchange’s proof of reserves that shows Shiba Inu (SHIB) as the second largest reserve holding. Currently, the total reserves with the exchange are worth more than $2 billion, out of which it holds almost $570 million in SHIB.

In addition, the exchange’s largest allocation is in Bitcoin (BTC) with almost $900 million allocated towards the crypto market leader. This also makes up 30% of the portfolio. Its third largest allocation is Ethereum (ETH) with nearly $500 million, which is over 17% of the reserve holdings.

Stablecoins such as USD Coin (USDC) and Tether (USDT) make up just over 5% of the exchange’s allocation each. In related news, the platform’s native token, Cronos (CRO), is trading at $0.08146 following a 13.00% drop in price over the last 24 hours, according to CoinMarketCap. After establishing a daily high at $0.09423, CRO’s price is currently trading closer to its 24-hour low at $0.08124.

The price of CRO plummeted over the last week after setting a local top near $0.1300. The sell volume that entered the market 4 days ago was too much for CRO’s key support level at $0.1014 as CRO’s price dropped to $0.0784. The dramatic decline in CRO’s price also forced the daily 9 and 20 EMA lines to cross bearish.

During this time, the daily RSI line also crossed bearishly below the RSI SMA line to take the RSI value into oversold territory.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.