- SHIB’s trading volume suffered an almost 30% decrease.

- The meme coin’s burn rate is down by more than 90% over the last day.

- Technical indicators are sending mixed messages about what to expect from SHIB.

The Shiba Inu (SHIB) Ecosystem released its Canyon art concept on October 4, but despite this new development, the excitement surrounding the SHIB metaverse seems to be almost nonexistent.

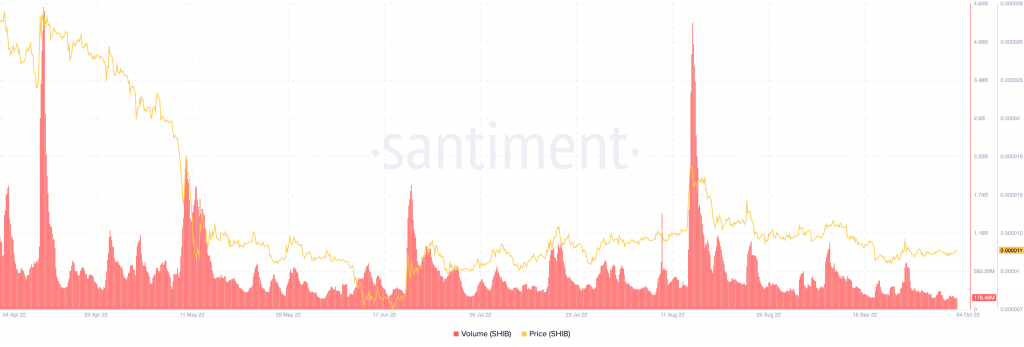

This point is proven by the fact that SHIB’s volume is showing no signs of anticipation from the community. Over the last 24 hours, SHIB’s trading volume suffered an almost 30% decrease and now stands at about $243,354,337.

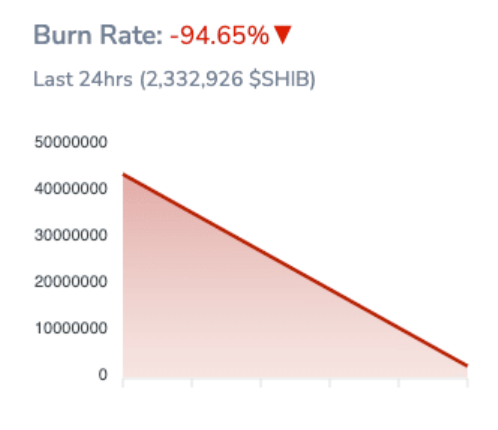

In addition to this, SHIB’s burn rate also took a hit. According to the ShibBurn website, the SHIB burn rate saw a 94.65% decrease over the last day.

On the technical side, it seems like SHIB’s daily chart is indicating that the meme coin is subtly moving toward a more stable buying level. This is illustrated by the momentum shown by the Relative Strength Index (RSI).

SHIB’s RSI is now at 47.08, which further confirms that SHIB has left the massive selling zone it has been struggling with since September 21.

On the other hand, SHIB’s Average Directional; Index (ADX) indicates that there is weak strength when it comes to potentially supporting any kind of advantage. The meme coin’s ADX is below 25, which supports the fact that bearish momentum is close by.

Things are looking different on SHIB’s Money Flow Index (MFI) as it showed decent buying momentum and signs that investors are interested in pumping some liquidity into the crypto to sustain the RSI condition.

This MFI increase could sustain the current SHIB price rise, but it does seem like the crypto is still very susceptible to larger market conditions.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.