- Solana (SOL) has flipped Shiba Inu (SHIB) in market capitalization.

- On Wednesday, the price of Solana (SOL) increased by more than 13% in 24 hours.

- The price spike has resulted in the liquidation of around $6.7 million worth of short positions.

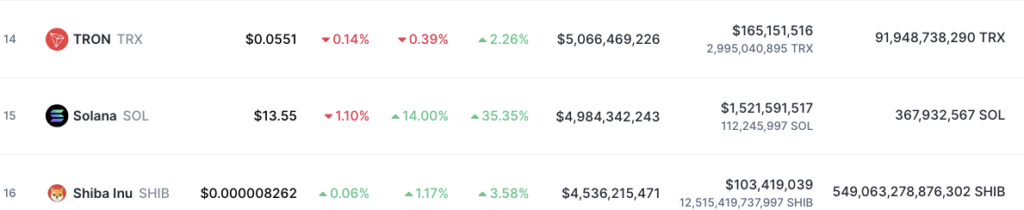

Solana is now ranked 15th on the list of the top 20 cryptocurrencies, as shown by the prominent cryptocurrency reference portal CoinMarketCap. The Shiba Inu has dropped one position and is now ranked 16th, while the TRX from Tron is in 14th place.

The total market capitalization of SOL is now $5,025,148,157, while SHIB’s is at $4,533,581,557. There is also a significant gap in their trading volumes, though in this regard, SOL still maintains its lead over SHIB, which accounts for the second biggest meme currency. SOL’s $1,501,978,822 in trading volume compares to SHIB’s $102,269,372.

SOL, the native token of the Solana blockchain, has gained a significant amount in comparison to its value in only one week, gaining as much as 35% in the same trading period according to Coinmarketcap data.

On Wednesday, the price of Solana (SOL) increased by more than 13 percent despite a significant drop that brought it to its lowest levels since February 2021. This also follows almost nine days of continuous declines, which dropped its price down to roughly $8 on Friday.

According to Coinglass, the current price spike has resulted in the liquidation of around $6.7 million worth of short positions. Since the failure of the FTX exchange in November and the following meltdown of the market, this is the greatest short liquidation that has taken place.

According to the data provided by Coinglass, funding rates for SOL permanent swaps are significantly negative. This indicates that traders are pessimistic and wagering for the price of the token to plummet, which is also referred to as “shorting”.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.