- Solana price trades near $221, consolidating inside a triangle as buyers defend $219 support.

- Coinglass data shows $56M in outflows, signaling accumulation despite near-term consolidation.

- Bitwise ETF update and Solana’s dominance in tokenized stock trading reinforce bullish sentiment.

Solana price today trades near $221, stabilizing after slipping from resistance at $225–$226. The broader setup shows the asset consolidating inside a symmetrical triangle, with buyers protecting the ascending support line near $219.

Solana Price Defends Ascending Support

The 4-hour chart shows SOL trading within a narrowing triangle pattern, caught between the rising support trendline near $219 and the descending resistance at $226. The structure suggests a potential breakout in the coming sessions, as volatility compresses between the 20- and 50-EMAs.

Immediate support lies at $219–$220, followed by deeper cushions at $215 and $212, marked by the 100- and 200-EMAs. A close above $226 could trigger an upside push toward $233–$238, while failure to hold $219 risks a breakdown toward $210.

Related: Ethereum Price Prediction: ETH Holds Key Fibonacci Level Ahead of Fusaka Upgrade

RSI sits near 44, showing neutral momentum after cooling from recent overbought levels. The technical bias remains cautiously bullish as long as the rising base holds.

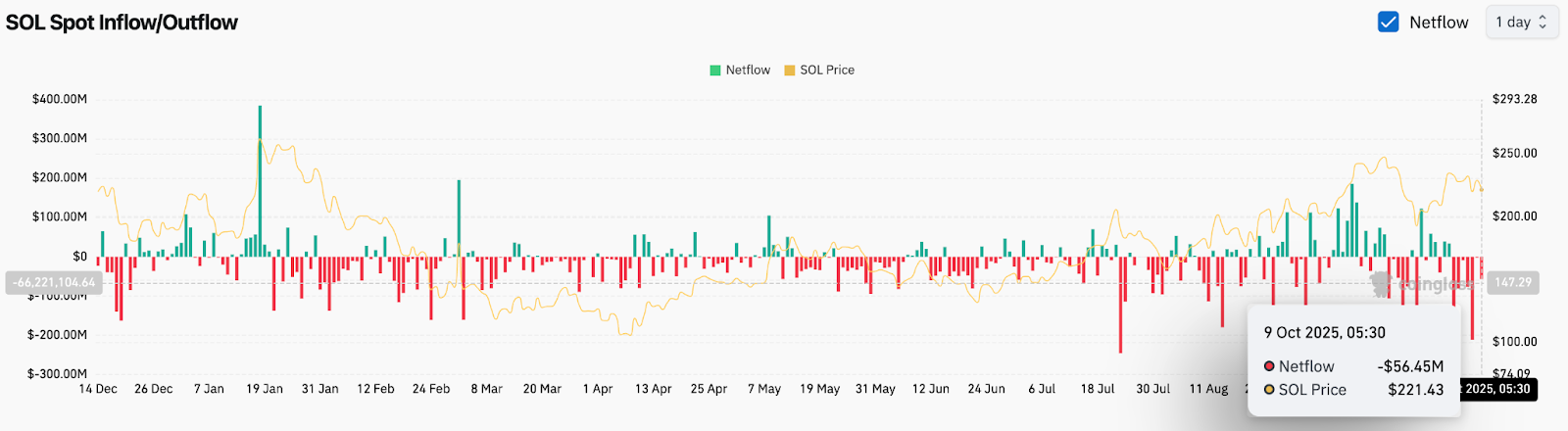

On-Chain Data Shows $56M Outflows

Exchange data from Coinglass recorded a $56.4 million net outflow on October 9, signaling steady accumulation despite weaker price action. Outflows typically indicate reduced selling pressure, and this trend reinforces that traders are moving SOL off exchanges in anticipation of longer-term holding.

Flows over the past week show alternating spikes, but the dominance of outflows suggests underlying accumulation remains intact. This pattern aligns with the price consolidation near key support, reflecting investor patience ahead of a possible volatility expansion.

Bitwise ETF Update Reignites Institutional Interest

Sentiment improved after Bitwise filed an update to its Solana ETF proposal to include staking, with a 0.20% fee structure. The addition strengthens Solana’s institutional narrative by introducing passive yield opportunities within a regulated product framework.

Related: Bitcoin Price Prediction: Polymarket and Ex PayPal Chief See $1.3M BTC

Market analysts note that integrating staking into the ETF could make it more appealing to traditional investors seeking yield exposure in the digital asset space. The news follows months of speculation over a Solana ETF launch and positions the network as the next major contender after Bitcoin and Ethereum.

Solana Leads Tokenized Stock Market Activity

Further boosting sentiment, SolanaFloor data shows Solana accounted for over 95% of total tokenized stock volume in the past 30 days. This dominance outpaces Gnosis and Ethereum, highlighting Solana’s expanding influence in decentralized trading infrastructure.

The milestone demonstrates the network’s growing use in tokenized equities, a market projected to grow significantly as regulatory clarity advances. Analysts see this as a key structural advantage that may support Solana price action through the next market cycle.

Outlook. Will Solana Go Up?

The next move for Solana hinges on whether buyers can maintain control above $220 amid tightening consolidation. On-chain data and ETF-related news continue to favor accumulation, while technical compression suggests a breakout is approaching.

Related: PancakeSwap (CAKE) Price Prediction 2025–2030

As long as the $219 support trendline holds, analysts expect Solana price to attempt a move toward $233–$238 in the short term. A daily close below $219 would invalidate this outlook and reopen downside risk toward $210.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.