- SEC approves Grayscale Solana Trust ETF, paving way for NYSE Arca listing.

- SOL trades at $194 inside triangle pattern, eyeing $225 breakout zone.

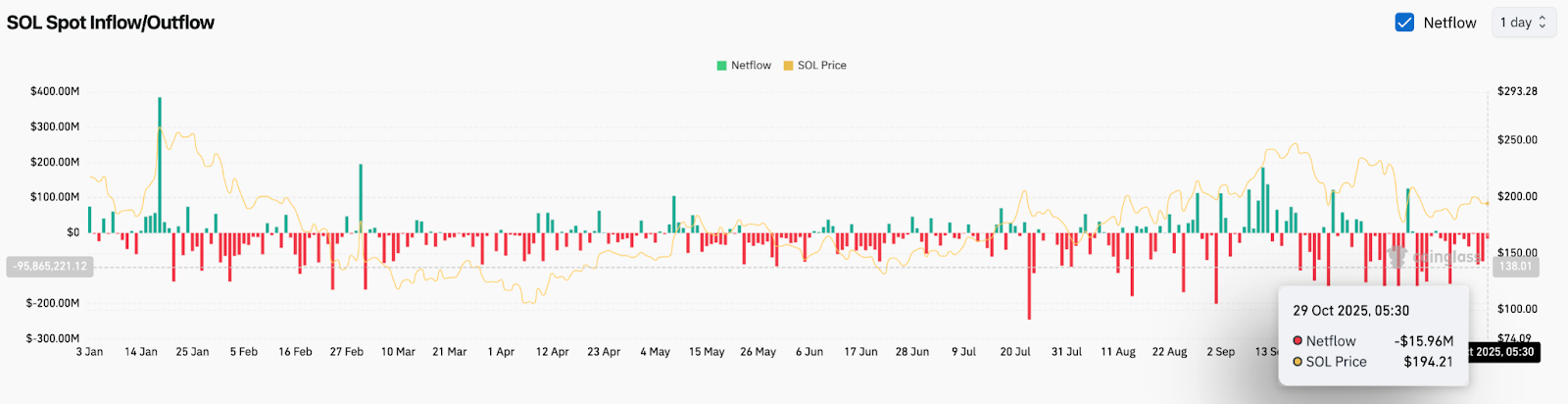

- On-chain flows show $15.9M outflows, signaling cautious sentiment despite ETF catalyst.

Solana (SOL) price today trades near $194.19, holding steady after a volatile session that saw limited movement ahead of key resistance. The market’s focus has shifted sharply following confirmation that the Grayscale Solana Trust ETF has received official listing and registration approval from the U.S. Securities and Exchange Commission (SEC).

ETF Approval Sparks Renewed Interest In Solana

In a post on X, Solana’s official account confirmed the SEC approval of the Grayscale Solana Trust ETF, paving the way for listing on the NYSE Arca. The development positions Solana as one of the few non-Bitcoin and non-Ethereum assets to achieve trust-level recognition in the U.S. market.

The news drove a sharp intraday rebound across Solana-linked products, though broader crypto sentiment remains tempered by macroeconomic uncertainty and the Federal Reserve’s upcoming policy announcement. For traders, the ETF listing represents validation of Solana’s growing adoption and institutional reach — a factor that could drive deeper liquidity inflows in the months ahead.

Related: Bitcoin Price Prediction: BTC Price Consolidates as Open Interest Hits $73B

Price Action Holds Inside Symmetrical Triangle

On the daily chart, Solana continues to trade within a tightening symmetrical triangle pattern, with the upper resistance line capped near $225.50 and the ascending trendline offering support around $187.00. This consolidation phase has persisted since mid-year, compressing volatility and setting the stage for a potential breakout as the pattern nears completion.

Key exponential moving averages (EMAs) offer important near-term guidance. The 20-day EMA sits at $196.59, overlapping closely with the current price, while the 50-day and 100-day EMAs at $202.11 and $197.57 define the immediate resistance zone. A decisive close above this band would strengthen the case for a bullish breakout toward $214.29, followed by the Supertrend level at $225.52.

On the downside, failure to hold the $187 trendline could expose a drop toward $175, where previous structural support emerged in early October.

Related: Official Trump Price Prediction: TRUMP Eyes $10 Target On Speculative Rotation

On-Chain Flows Suggest Modest Outflows Despite ETF News

According to Coinglass data, Solana recorded a net outflow of $15.96 million on October 29. The reading continues a multi-week pattern of moderate capital rotation, with sellers outweighing buyers on several major exchanges.

While these figures indicate profit-taking rather than heavy liquidation, the consistent red prints across October show that institutional positioning has yet to shift decisively bullish despite the ETF catalyst. Sustained green inflow days would be required to confirm accumulation and validate a new upward trend.

Outlook: Will Solana Price Go Up?

For now, the Solana price prediction leans neutral-to-bullish. The asset trades at a key inflection point within its multi-month triangle, supported by a strong fundamental driver in the form of ETF approval but constrained by lackluster exchange inflows.

If buyers manage to push SOL above $202 and sustain momentum toward $214, a breakout toward $225–$240 could unfold swiftly. Failure to defend the $187 support, however, risks sending the price back toward $175 before any renewed attempt higher.

Related: Pi Price Prediction: Rally Cools as 121 Million Tokens Near Unlock

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.