- SOL was one of the few cryptos that were able to print a gain in the past 24 hours.

- At press time, the altcoin was hovering above the key support level at $21.5.

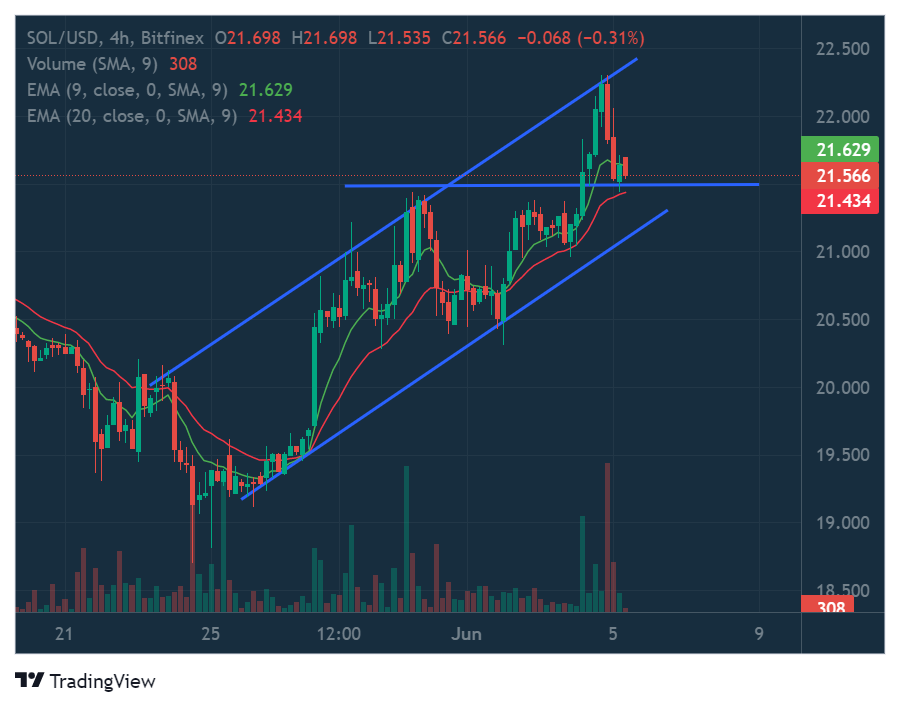

- There was a medium-term price channel on SOL’s 4-hour chart which suggested that its price could continue to rise.

Solana (SOL) was one of the handful of cryptos that were trading in the green today. At press time, CoinMarketCap indicated that the Ethereum-killer was changing hands at $21.58 following a 0.18% price increase in the past 24 hours. This added to the altcoin’s positive weekly performance – pushing the total gain over the past 7 days to +4.18%.

The altcoin also outperformed the two market leaders Bitcoin (BTC) and Ethereum (ETH). SOL was up 1.46% against the leading crypto, BTC, and up 1.64% against ETH. As a result, 1 SOL was worth 0.0008042 BTC and 0.01152 ETH.

From a technical perspective, SOL had been in a positive price channel for the past few weeks. During this period, the crypto was able to flip the resistance levels at $20.44 and $21.5 into support – to reach a high of $22.303.

Since reaching the $22.303 mark, SOL’s price had retraced and was hovering above the aforementioned $21.5 level at press time. After opening the latest 4-hour candle at $21.698, SOL had also pulled back to trade below the 9 EMA line on the 4-hour chart.

If SOL’s price fails to close a 4-hour candle above this EMA line within the next 12 hours, then it will be at risk of dropping to as low as $21.250 in the coming 24 hours. Should this happen, SOL could trade at the lower level of the long-term positive price channel.

If bulls step in at this level, then SOL’s price might recover to trade back above the key $21.50 level in the following 48 hours. Conversely, if bulls fail to defend the $21.50 mark, the altcoin could most likely drop to $20.50 in the next few days.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.