- Solana price holds $224–$230 support while testing $240–$246 resistance cluster for the next breakout.

- On-chain data shows $9.6M outflow, but inconsistent flows highlight fragile demand and cautious positioning.

- Solana ecosystem dominance grows, with 85M of 100M new tokens launched on the network in 2025.

Solana price today is trading near $234, slightly lower after failing to break past the $240–$246 resistance cluster. Buyers are protecting the $230–$224 area, which is where the breakout trendline and the 20-day EMA meet. The fight now depends on whether SOL can get back above $246 and gain momentum, or if it will fall back to lower support levels.

Solana Price Holds Rising Channel Support

The daily chart shows that Solana is moving in a rising wedge pattern, with support right now between $224 and $220. The 50-day EMA is at $203 and the 200-day EMA is at $177, showing that the broader uptrend is still strong.

Related: WLFI Price Prediction: Will WLFI Price Hit $1 in the Next 15 Days?

Momentum indicators are still positive, but they are starting to cool off. The Parabolic SAR has turned lower, which means there will be a short-term pullback, and the RSI has moved away from being overbought. The overall bullish trend will stay that way as long as SOL stays above the $224 support floor. If it falls below that level, it could open up the $203–$188 levels.

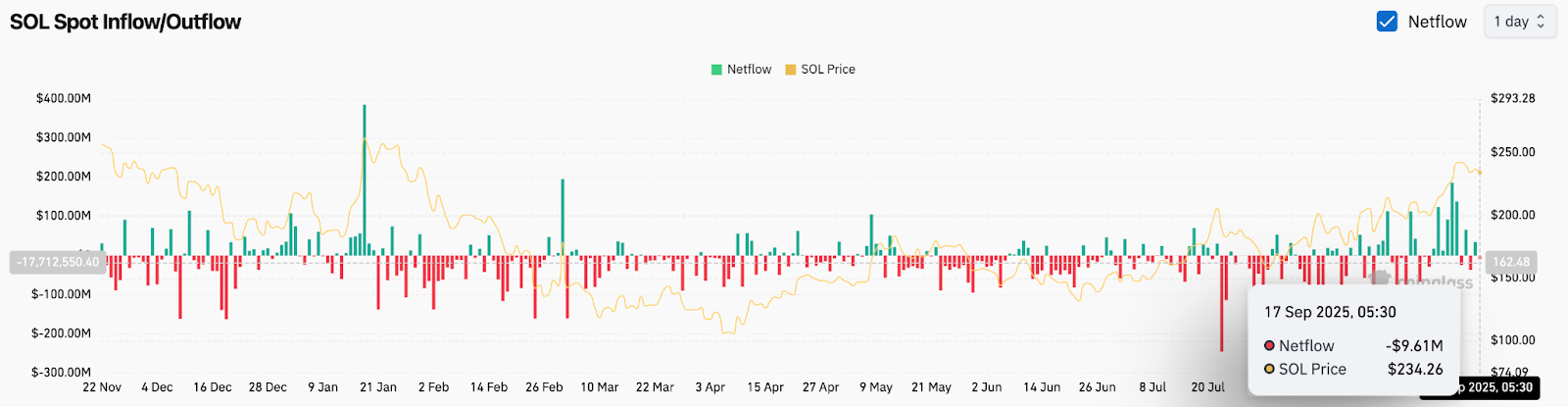

On-Chain Flows Signal Fragile Demand

Exchange data shows a $9.6 million net outflow on September 17, indicating mild accumulation after weeks of volatile activity. Despite this, flows have lacked sustained conviction, with spikes of inflows and outflows offsetting each other.

Analysts warn that without consistent inflows, Solana price action could struggle to maintain upward momentum. Futures open interest has also stabilized, pointing to cautious positioning rather than aggressive bullish bets.

Solana Ecosystem Growth Provides Tailwind

Fundamentally, Solana’s dominance continues to expand. Data from Blockworks shows that Solana deployed an overwhelming 85 million of the 100 million tokens launched across major networks. This reflects its growing role as the leading platform for memecoins, gaming assets, and project tokens.

Related: Avantis (AVNT) Price Prediction 2025, 2026, 2027, 2028–2030

The scale of adoption adds long-term credibility to Solana’s valuation and provides a cushion against near-term volatility. Traders view this as a powerful tailwind that could attract new liquidity, especially if technical levels align with bullish sentiment.

Smart Money Concepts Highlight Key Levels

The 4-hour chart underscores the battle at $246, marked as a weak high under the Supertrend resistance zone. Immediate demand blocks lie at $225 and $215, while deeper liquidity sits near $200.

Breaks of structure (BOS) remain intact from the September rally, suggesting that the current consolidation may be a mid-cycle pause rather than a reversal. A sustained close above $246 would confirm bullish continuation, opening the door to the $253 and $270 levels.

Technical Outlook For Solana Price

Solana price prediction for the short term remains hinged on key support and resistance:

- Upside levels: $246, $253, and $270 if momentum returns.

- Downside levels: $224, $220, and $203 as critical defense points.

- Trend support: $188 and $177 as the last major lines of defense.

Outlook: Will Solana Go Up?

The path forward for Solana depends on whether buyers can overcome the $246 ceiling before sellers gain traction at $224. On-chain data shows cautious accumulation, while ecosystem growth continues to provide a compelling narrative for long-term holders.

Analysts remain optimistic as long as SOL stays above $220. A decisive breakout above $246 could trigger an extension toward $270, while losing $224 would delay the bullish thesis and shift focus back toward the $200 zone. For now, Solana remains in a consolidation phase within its broader bullish cycle.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.