- Currently, the SOL market is favoring the bulls, with prices trending upwards.

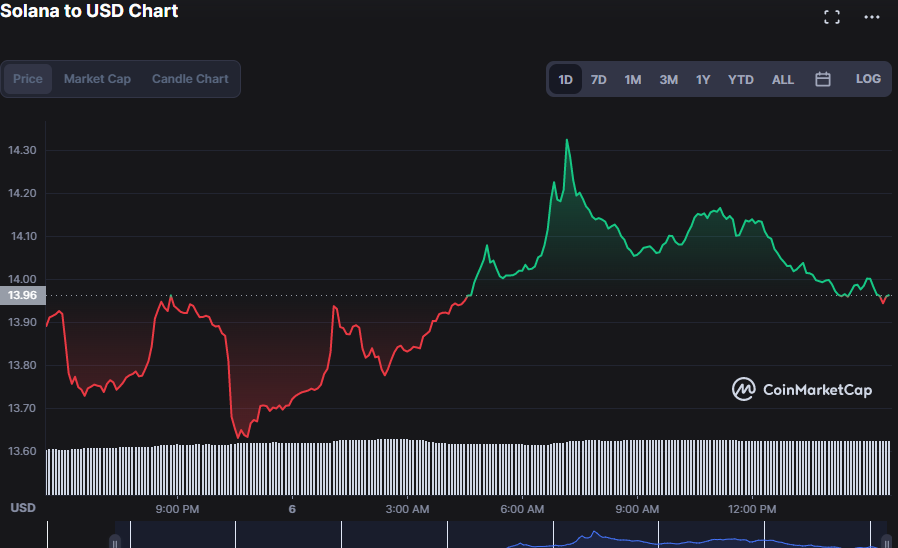

- Solana prices were pushed lower by bears, but they eventually found stability around $13.63.

- A continuation of the bullish trend would be signaled by a break over the resistance level.

Bears initially had control of the Solana (SOL) market, sending prices down to a low of $13.63. Later in the day, however, a surge of buyers swooped in and reversed the bear trend, propelling SOL prices higher until they hit resistance at $14.32.

At the time of writing, SOL was valuing $14.09, up 1.41% from the previous trading day’s close.

Market cap has climbed by 0.70 % to $5,107,296,540, and 24-hour trading volume has climbed by 26.01 % to $322,016,142, all of which reflect SOL’s current upward impetus.

If the Keltner Channel’s bands are moving linearly, then means that the amount of demand and supply is roughly equal. The bands cross at 14.31 and 13.69, respectively, proving the motion in question. Moreover, the price’s movement towards the upper range lends credence to the SOL market’s optimistic trend.

An additional factor supporting this bullish preeminence in the SOL market is the Coppock Curve’s upward motion (2.36). However, its current trend to the downside has traders worried, as it suggests that bull power is ebbing.

Klinger Oscillator value of -1.289K indicates a bearish trend, so extra care should be exercised. As a general rule, it is best to engage in short trades when the Klinger line crosses below the signal line.However its pointing upwards gives investors hope for a further bull run as it tries to outdo its SMA line.

The 5-day MA crosses over the 20-day MA at 14.02 and 13.99 respectively , forming a bullish golden cross. Price action above both moving averages suggests a continuation of the bull market.

As long as the bulls in the Solana (SOL) market continue to outrun any bear attempt at market capture, the current bullish trend is expected to continue.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.