- Crypto exchange Ripple ranks tenth among leading unicorns in the US.

- Ripple demonstrates a market valuation of $15 billion.

- The firm submitted its final motion against the US SEC on December 2.

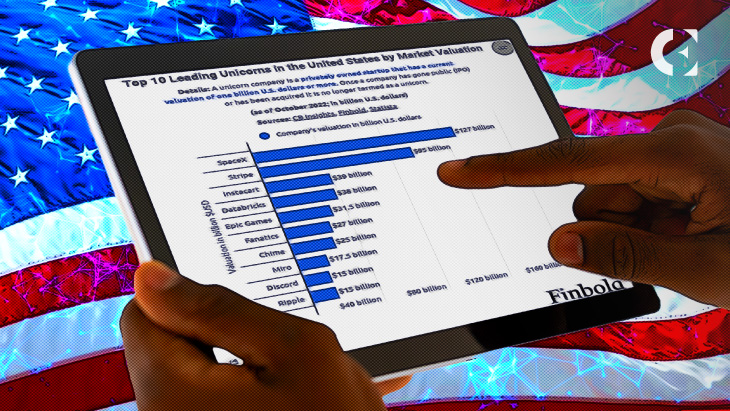

Cryptocurrency exchange Ripple was listed among the top ten leading unicorns in the United States as per market value, according to a report published by infographic software company, Infrogram.

The payment protocol created by Chris Larsen and Brad Garlinghouse ranked number 10 on the list with a market valuation worth $15 billion. Moreover, the published information has been collected and combined from the private equity firm CB Insights, news platform Finbold, and Consumer and Market data company Statista.

The report defines a unicorn as a privately owned startup that has a current valuation of one billion U.S. dollars or more. Hence, when the company goes public with an IPO or gets acquired, it is no longer termed a unicorn.

According to the data, Elon Musk’s spacecraft manufacturer, Space X ranked number one on the list with a market valuation of $127 billion. Following SpaceX, the financial services company Stripe, with CEO Patrick Collison, ranked second with a market value worth $95 billion.

Other names on the list included retail company Instacart, software company Databricks, and video game company Epic Games, with market valuations worth $39 billion, $38 billion, and $31.5 billion, respectively.

Ripple has been engaged in a lawsuit against the United States Securities and Exchange Commission (SEC) for two years now, however, the end of that is near. On December 2, Ripple filed its final submission in the case against the regulators.

In its final submission, Ripple concluded that “the court should grant Defendant’s Motion and should deny the SEC’s Motion,” while arguing that the SEC has not been able to prove that XRP offerings from 2013 to 2020 were associated with an “investment contract,” and thus a security under federal security laws.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.