- DappRadar released a report on NFT sales and trading volume.

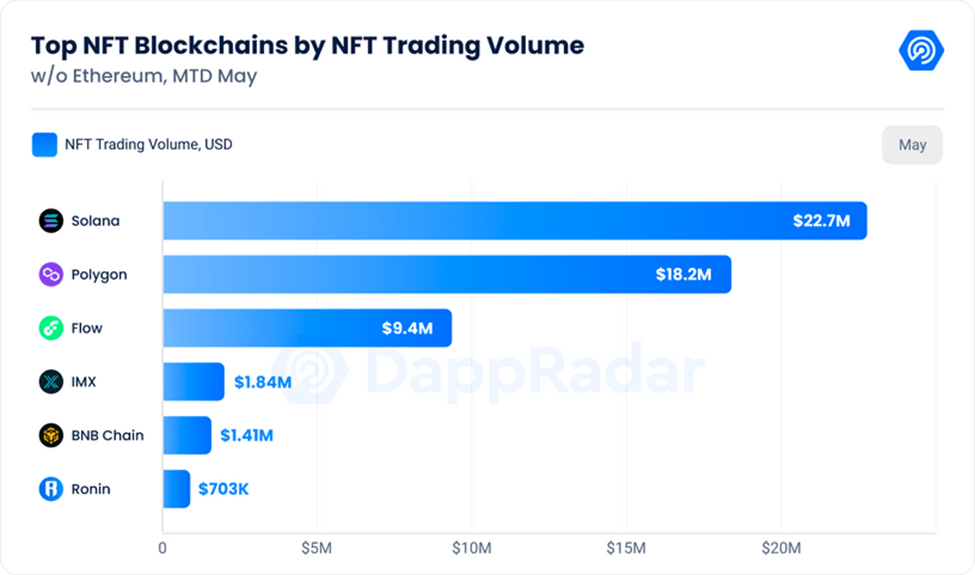

- The report unveils that Solana ranks highest for top NFT blockchains by trading volume.

- Solana competes with Polygon, which has a 26.9% dominance over NFT sales.

The latest NFT report by DappRadar shows that Ethereum’s dominance of the NFT market when it comes to NFT sales has slipped to just 5.7%. DappRadar also highlighted that the drop in Ethereum’s NFT sales dominance shows that the blockchain is primarily used by the NFT aristocracy.

The report reveals that Solana is right behind Ethereum, bagging the second spot with a trading volume of $22.7 million. The Solana blockchain represents 6.7% of the total NFT trading volume. It also has a 13% share of total NFT sales.

With a remarkable trading volume of $18.2 million and an impressive 26.9% dominance in NFT sales, Polygon has solidified its position as the most prominent blockchain in terms of sales count.

This achievement is a testament to Polygon’s recent strategic decisions, as it has become the preferred choice for numerous Web 2.0 projects aiming to launch NFT initiatives at a low entry price. Additionally, Polygon’s ecosystem includes a multitude of games incorporating NFT mechanics, such as Planet IX, The Sandbox, and Oath of Peak.

Polygon has also emerged as the most popular blockchain in 2023 so far. The data from NFT Data shows that Polygon’s popularity went up from 23% in 2022 to 41% in Q1 2023. This has also attracted some notable industry players, including Nike, Reddit, and Starbucks.

The DappRadar data also showed that NFT sales could drop below $1 billion in May. According to the data, the trading volume currently stands at $333 million from 2.3 million sales.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.