- Celsius took to Twitter on September 15 to make an announcement.

- Following the announcement, the price of CEL saw a 30% increase.

- CEL is currently trading at $1.76 according to CoinMarketCap.

Celsius took to Twitter on September 15 to make an announcement regarding the Unsecured Creditor Committee and U.S. Trustee. After this Tweet was released, the price of the network’s native token, CEL, saw a 30% price surge. In addition to this, over the last 90 days, Celsius’ social media engagements grew by 31.46%.

At our hearing today and throughout our case, Celsius continues to engage with the Unsecured Creditors Committee and U.S. Trustee to make meaningful progress on our efforts to maximize value for all customers and ensure transparency in our case.

— Celsius (@CelsiusNetwork) September 15, 2022

According to the Twitter post, Celsius will continue to work with the Unsecured Creditors Committee and U.S. Trustee. The company also committed to “making meaningful progress in their efforts to maximize value” for all of their customers.

Unfortunately, things are not looking so great at the moment as CEL is now down more than that at the time of writing. According to the market tracking website, CoinMarketCap, CEL is currently trading at $1.76. Despite the token being down almost 30.5% over the last 24 hours, CEL is still 27.95% in the green over the last seven days.

CEL’s 24 hour trading volume is also currently standing at $68,726,677 after a 6.80% increase.

Despite the short-term surge in CEL’s price, and the increased social engagement towards the token, it is obvious that there is still reason for concern surrounding the cryptocurrency.

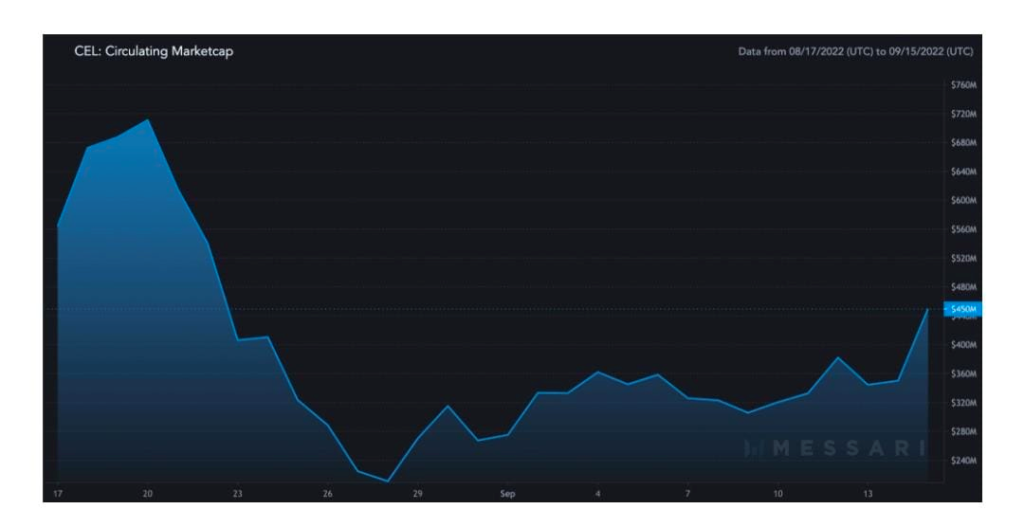

One of these concerns is the fact that Celsius’ circulating market cap went down by 32.64% over the past month. In addition to this, its market cap dominance also decreased by 39.02%. This all led to a lot of uncertainty about the CEL token and investors should proceed with extreme caution.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.