- Crypto trader DonAlt questions why people are currently shorting the crypto market.

- The trader believes that the current banking crisis is a bullish sign for the crypto market.

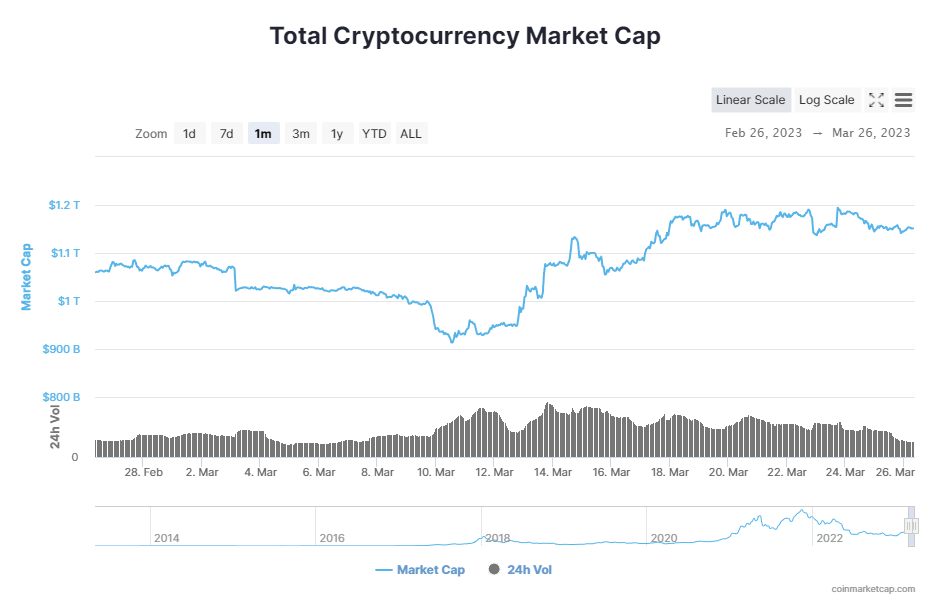

- In related news, the total crypto market is consolidating between $1.1 trillion and $1.2 trillion.

The crypto trader and analyst. DonAlt (@CryptoDonAlt), tweeted yesterday regarding Bitcoin (BTC). In the tweet, the crypto analyst stated that all he sees is “disbelief,” as he mentioned the extreme divide in the crypto market.

The analyst questioned why people are shorting the crypto market following the current banking crisis, especially after a 9-month “bullish reclaim & range breakout.”

At press time, CoinMarketCap shows that the total crypto market cap stands at around $1.15 trillion. This is a slight 0.05% increase in the last 24 hours.

The global crypto market cap recovered back above the $1 trillion mark on 13 March after dropping below the key level on 9 March. Since recovering back above $1 trillion, the total crypto market cap has consolidated between $1.2 trillion and $1.1 trillion.

Meanwhile, the majority of the top 10 cryptos by market cap have seen their prices increase over the last 24 hours. The prices of the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH) are up 0.03% and 0.15% in the last 24 hours. As a result, BTC’s price stands at $27,533.19 at press time while ETH is currently trading at $1,752.92.

Binance Coin (BNB) and Ripple (XRP) are up 0.09% and 2.73% respectively. Currently, BNB’s price stands at $324.13 and the remittance token’s price stands at $0.4569.

Unfortunately, Cardano (ADA), Dogecoin (DOGE), and Polygon (MATIC) were not able to print 24-hour gains. ADA’s price is down 1.64% over the last 24 hours to trade at $0.3559. DOGE and MATIC are trading at $0.07468 and $1.09 after dropping 0.47% and 1.76% respectively.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.