- SHIB has been showing signs of growth on some fronts.

- At the time of writing the burn rate stood at about 250%.

- When looking at SHIB’s 24-hour chart, the overall trends still seems to be bearish.

Over the weekend, things have been looking good for Shiba Inu (SHIB), considering it saw a 2% increase in price for a few hours today. Despite the meme coin still being about 60% off its all-time high, the token’s recent moves have been received positively by most of its holders.

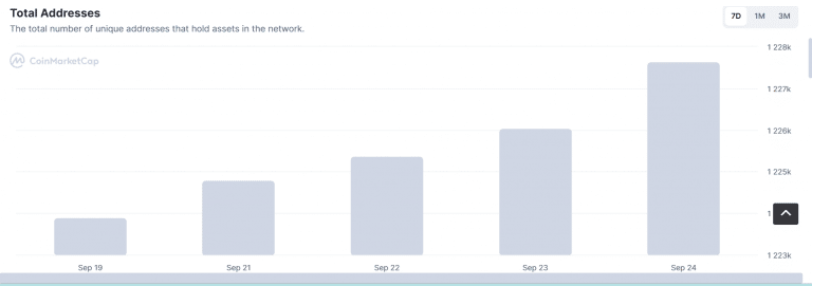

SHIB has also been showing signs of growth on some fronts, including its number of addresses. This number has been steadily increasing over both the long and short term. Between September 19 and 24, around 3,000 new addresses were registered on the network, according to the market tracking website, CoinMarketCap. In addition to this, 35,000 new holders joined the network in just three months.

The Shib burn is also still going full steam ahead. At the time of writing the burn rate stood at about 250%.

When looking at SHIB’s 24-hour chart, the overall trend still seems to be bearish, although this might be changing. One of the indicators that prove that the bearish sentiment is waning is the Directional Movement Indicator (DMI).

The DMI on the 1-day chart shows the signal line and the plus DI resting barely over 20, which indicates a wavering bearish trend and the possible start to a bullish one.

Also, the volume indicator reported rather decent trade activities with buyers taking a larger percentage to the trading volume. If this buying pressure continues, SHIB has the potential to visit the $0.000014 region.

Traders overall seem to trust the long-term potential of the meme coin considering 67% have been holding their tokens for 1-12 months, and 30% have been holding for over a year.

SHIB is currently trading at $0.00001113 after a 2.54% drop in price over the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.