- Polygon has been showing some growth in the Layer 2 space.

- High-profile collaborations are not going to plan for Polygon.

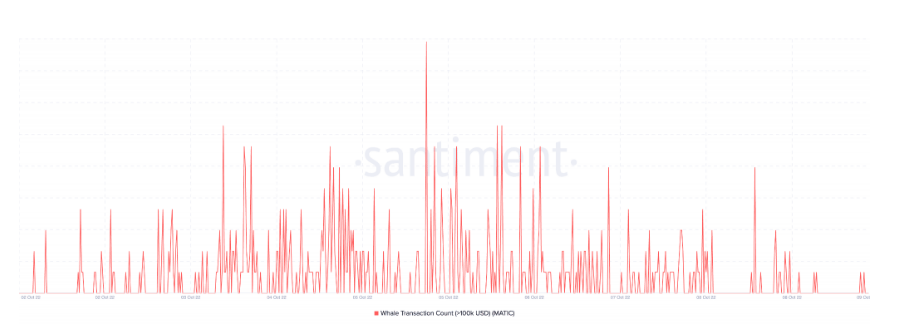

- The number of whale transactions for MATIC saw a big drop.

Polygon (MATIC) has been showing some growth in the Layer 2 (L2) space throughout the year. However, the question still remains: will Polygon be able to continue its growth despite the current conditions in the cryptocurrency market? Polygon’s plans to dominate the Web3 space might help them do just that.

According to a new report, Polygon has a high-profile growth strategy focused on the NFT, DeFi, and gaming areas. In addition to this, Polygon has partnered with some major brands in the industry, like Meta and Disney, to get an edge in the NFT space.

When it comes to the GameFi space, Polygon hired people from big companies like YouTube to increase their influence just a bit more. Polygon’s sights are also on DeFi and DApps, and according to a report from Cumberland, about 37,000 DApps are using the Polygon POS.

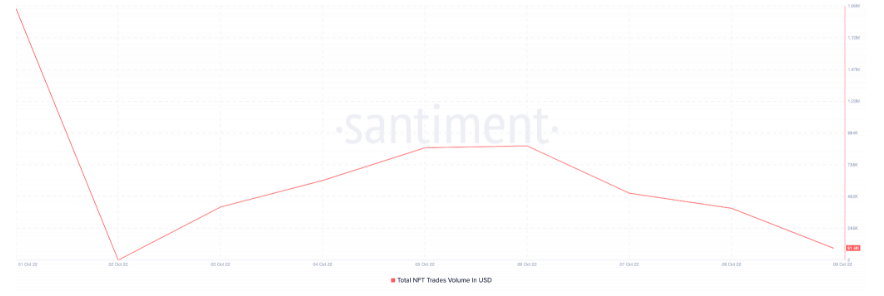

Unfortunately, all of these collaborations are not doing much for Polygon at the moment. According to data from the market intelligence firm Santiment, the NFT trade volume for Polygon went down considerably over the last week.

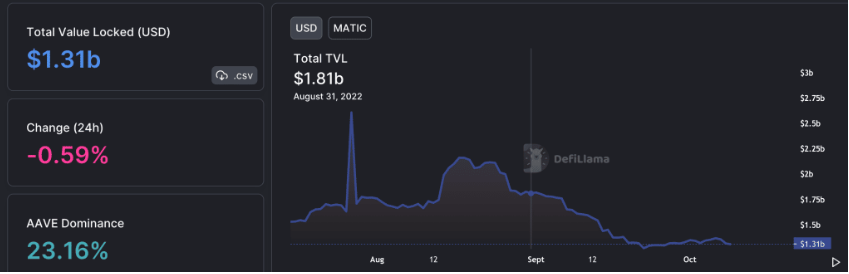

The Total Value Locked (TVL) for Polygon also declined significantly over the last two months, as can be seen from the chart above.

MATIC also witnessed some troubling numbers. Santiment reported that over the past few days, the number of whale transactions for MATIC saw a big drop. This could suggest that investors are losing interest in Polygon and are looking at other options for investment.

Development activity for Polygon has also been declining, which indicates that there are no updates or upgrades for investors to look forward to in the near future.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.