- Trump’s 25% tariff has rattled crypto, pushing Bitcoin to a notable dip.

- Crypto markets react as Trump’s tariffs create volatility for Bitcoin.

- Analysts link Trump’s trade policy to rising crypto uncertainty and risk.

President Donald Trump has declared new tariffs on steel and aluminum imports into the United States. He announced that all steel and aluminum imports into the United States will be subject to a 25% tariff. While similar tariffs were attempted during Trump’s previous term, there were some negotiations that eased the pressure on Canadian and Mexican suppliers.

However, this time, it’s unclear whether Trump intends to offer any relief or if he plans to stand firm. The newly proposed tariffs will target the five major suppliers of steel and aluminum to the U.S.—Canada, Mexico, Brazil, South Korea, and Vietnam. Canada, the largest supplier, accounts for a staggering 79% of all U.S. aluminum and steel imports.

Related: Bitcoin’s Price and MVRV Momentum Flash Warning Signs for Investors

Crypto Bears the Brunt

The crypto market, already in a downturn, felt the brunt of the announcement. Traditional markets, especially those tied to steel and aluminum, are also rattled. The Canadian dollar, which is heavily dependent on exports of these materials, is likely to take a hit this week.

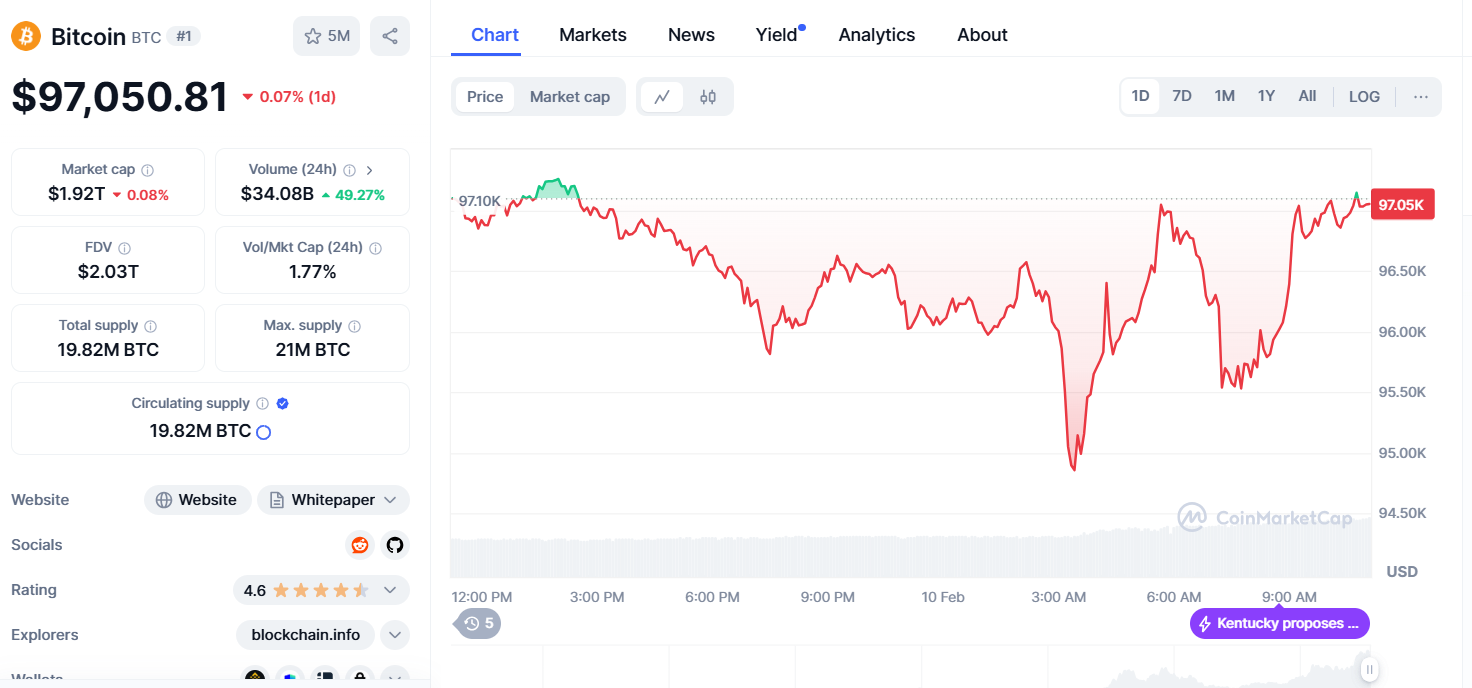

Bitcoin is attempting to climb back above $97,000 after briefly falling to $94,000. XRP and Dogecoin have faced a tougher hit, both dropping by 4%. The market cap stood at $3.16 trillion, down by 0.95%. The Fear & Greed index registered 35, which indicated a fear-driven market. According to Coinglass, in the past 24 hours, total liquidations totaled $242.29 million.

2025: The Year of Volatility?

Currently, Bitcoin is holding strong between $95,000 and $96,000, with slight bounces from this support zone. However, a confirmed break below $95,000 would open the door to further downside, with the next support levels sitting between $92,000 and $93,000.

On the flip side, if Bitcoin held above $95,000, it might have stabilized for a while. A major resistance zone lay between $101,000 and $103,000, with further resistance between $106,000 and $107,000. These levels were critical for any potential upside movement.

Related: Bitcoin Bet Pays Off: Strategy₿ (MSTR) Outperforms Top Stocks

In the broader picture, continued volatility is expected in the following months as markets respond to the president’s statements and tariff actions. Trump’s frequent announcements, combined with global uncertainties, is sure to keep the market unsettled in the coming months.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.