- The U.S. Fed has released guidelines for Reserve Banks to review requests to access “master accounts”.

- The statement was released Monday on the Fed’s official website.

- These guidelines will provide a consistent and transparent process to evaluate requests.

The United States Federal Reserve (Fed) Board has announced final guidelines that will establish a risk-based, consistent, and transparent set of factors for Reserve Banks to utilize in reviewing requests to access Federal payment services and accounts. These new guidelines will be effective upon publication in the Federal Register, according to the Fed’s official website.

In an announcement made on Monday, the Federal Reserve Board shared these final guidelines which are substantially similar to those proposed in the Board’s May 2021 proposal, as well as its March 2022 proposal.

The Fed said in the statement, “Institutions that engage in novel activities and for which authorities are still developing appropriate supervisory and regulatory frameworks would undergo a more extensive review.”

The statement added that the guidelines will be used by Reserve Banks to evaluate requests from institutions offering new types of financial products that request access to “master accounts” with a transparent and consistent set of factors.

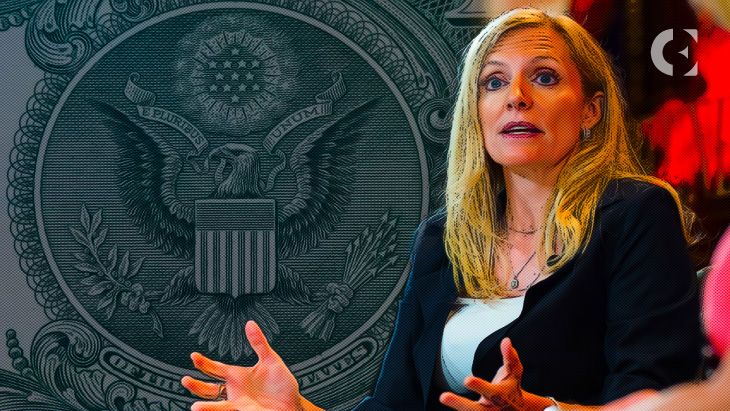

According to the Vice Chair, Lael Brainard, “The new guidelines provide a consistent and transparent process to evaluate requests for Federal Reserve accounts and access to payment services in order to support a safe, inclusive, and innovative payment system.”

These new guidelines will include a tiered review framework that will provide some additional clarity on the level of scrutiny and due diligence that Reserve Banks will need to apply to the differing types of institutions with varying degrees of risk.

The Federal Reserve Bank governor, Micelle Bowman, warned in a statement that the new guidelines are only the first step in providing a transparent process. “There is a risk that this publication could set the expectation that reviews will now be completed on an accelerated timeline.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.