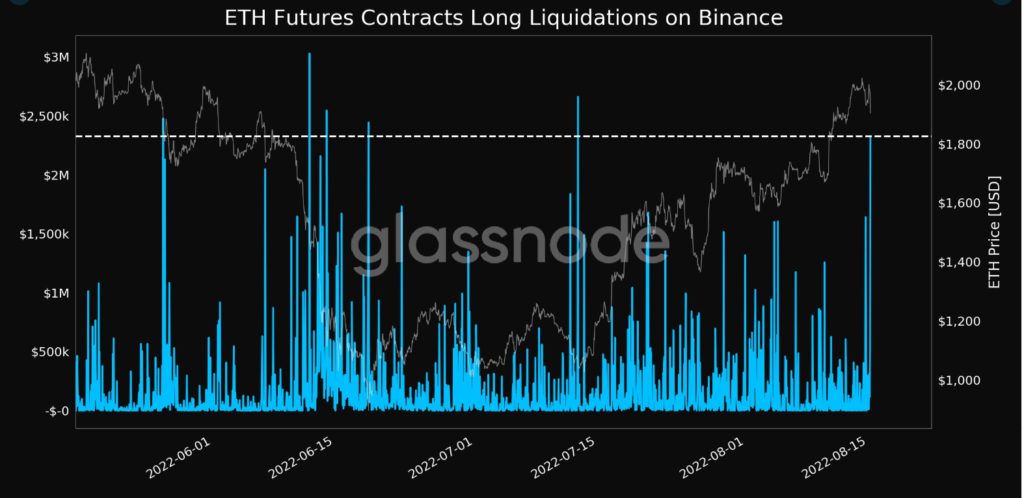

- ETH’s futures contract long liquidations reached a one-month high of $2,327,821.44 on Binance.

- The number of addresses holding at least 10 and 10k ETH spiked to ATH 313,562 and 1,186, respectively.

- ETH value has slipped 5.09% in the last 24 hours and is currently trading at $1,890.29.

With Ethereum’s Merge around the corner, transactions of the stablecoin have just witnessed some noteworthy activities over the last seven days.

The Ethereum (ETH) futures contract long liquidations reached a one-month high of $2,327,821.44 on Binance, which is nearly double of what ETH experienced last month, with $1,680,160.67 as its previous one-month high, recorded on July 20th, 2022.

According to metrics fetched from Glassnodes insights, the number of addresses holding over ten ETH reached an all-time high of 313,562. Meanwhile, the number of addresses with 10,000 ETH reached a one-month high of 1,186.

Furthermore, with the speeding transaction volume, the Mean Gas Usage of ETH over the seven-day moving average also reached its one-month high of 87,454.870. However, the number of active addresses for spot trading has plummeted to its one-month low in the last seven-day moving average at 31,755.298.

Based on data from Coinmarketcap, the value of ETH has slipped 5.09% in the last 24 hours and is currently trading at $1,891.12 (at the time of writing). Just 48 hours before the recent price movement, ETH had surpassed $2,000 for the first time since May.

Over the weekend, ETH was able to maintain its proximity to that threshold, reaching $2,022 on Sunday until today’s steep price decrease. Although it has experienced a considerable decline over the previous 24 hours, Ethereum is still up more than 55% over the past month, making it the best-performing currency of the month among the top ten largest cryptocurrencies during that period.

For the uninitiated, the past few weeks have seen Ethereum, the second-largest crypto in terms of market capitalization, gain traction among investors and the global crypto community as the Ethereum network prepares to switch from its current energy-intensive proof-of-work (PoW) consensus method to proof-of-stake (PoS) during the Merge event.

Although the Merge was first anticipated to occur around September 19, a revised tentative date of September 15 was later disclosed. Last week, developers set the terminal total difficulty (TDD), which determines when the network will generate its first PoS block.

The terminal total difficulty has been set to 58750000000000000000000.

This means the ethereum PoW network now has a (roughly) fixed number of hashes left to mine.https://t.co/3um744WkxZ predicts the merge will happen around Sep 15, though the exact date depends on hashrate. pic.twitter.com/9YnloTWSi1

— vitalik.eth (@VitalikButerin) August 12, 2022

In related news, a number of Ethereum validator nodes will be deployed in the city of Buenos Aires in 2023, the city’s secretary for Innovation and Digital Transformation, Diego Fernandez, clarified. He stressed that this deployment will pursue exploratory and regulatory goals and that it will assist the city in creating crypto regulations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.