- U.S. Congressman Brad Sherman has called on the SEC to look into investor concerns related to Grayscale’s GBTC.

- Sherman has highlighted investors’ concerns regarding the massive discount that GBTC is currently trading at.

- The lawmaker also questioned the role of Grayscale’s parent firm Digital Currency Group in GBTC’s decline.

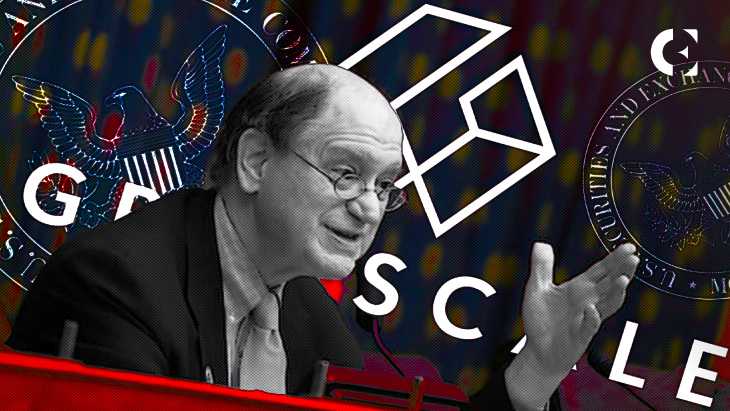

Brad Sherman, the United States Congressman representing California’s 32nd Congressional District recently highlighted investors’ concerns with Grayscale Investments’ Grayscale Bitcoin Trust (GBTC). The Congressman also asked Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC) to look into the matter.

Congressman Brad Sherman tweeted earlier today that he had penned a letter to SEC Chair Gary Gensler, asking the securities regulator to look into the business conduct of Grayscale in relation to its handling of GBTC redemptions. The lawmaker was particularly concerned about the 42% discount that GBTC shares were trading at.

According to Congressman Sherman, Grayscale has been refusing to redeem GBTC shares, citing the SEC’s Regulation M, which prohibits simultaneous sales and redemptions of the same security in order to limit market manipulation. The company has reportedly refused to offer redemptions even after ceasing sales of new GBTC shares.

Brad Sherman believes that “Grayscale’s actions with respect to GBTC are motivated by a desire to increase assets under management, regardless of its impact on GBTC investors.” The lawmaker believes Grayscale is avoiding enabling redemptions to avoid decreasing its 2% management fees, which helped the firm rake in $615 million in 2021.

Congressman Sherman also called into question the involvement of Grayscale’s parent firm Digital Currency Group (DCG), in the alleged manipulation of GBTC’s discount. In light of the above-mentioned issues, Congressman Brad Sherman has asked the SEC to look into Grayscale’s management of GBTC shares.

The lawmaker wants to know if Grayscale’s ongoing bid to convert GBTC into a spot Bitcoin ETF would allow the firm to enable shareholder redemptions. He also wants the SEC to see if it has any regulatory authority to step in and protect the “vulnerable retail investors in GBTC.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.