- Addresses holding between 100,000 to 10 million MATIC have been accumulating.

- Should MATIC retrace to $0.78, buying momentum may send it above $0.90.

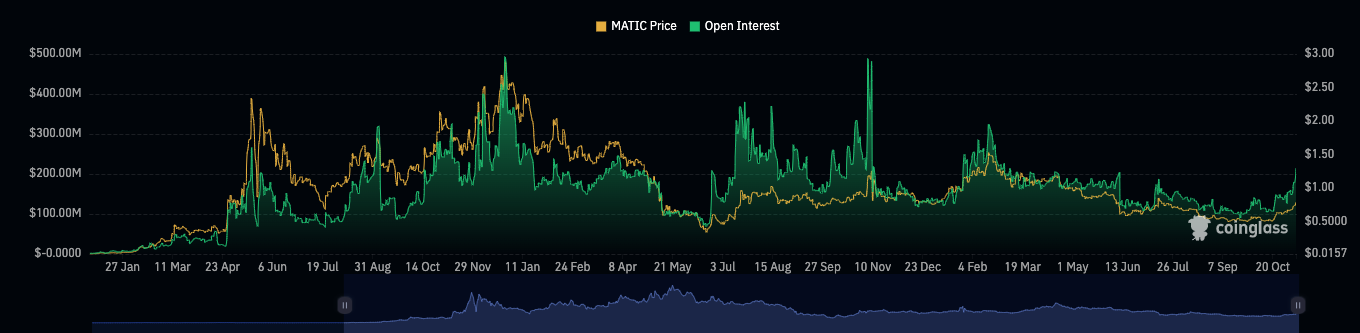

- Open Interest increased alongside the price action, indicating surging bullish momentum.

Like other altcoins, the price of Polygon’s MATIC token has been soaring. According to CoinMarketCap, MATIC’s value was $.080 at press time. The increase in price represents a 21.15% hike in the last seven days. Besides its price action, the market cap of MATIC has also risen by 54% in the last three weeks, according to data shared by on-chain analytic platform Santiment.

Santiment, in its November 9 post on X, noted that addresses holding between 100,000 to 10 million MATIC tokens have been accumulating heavily in the last two weeks. The surge in accumulation by these whales means there was an increase in buying pressure for MATIC. Hence, it was almost inevitable for the price not to increase, combined with the widespread bullish sentiment in the market.

At the time of writing, MATIC had formed a solid bullish structure based on the 4-hour chart. The Bollinger Bands (BB) also showed that the volatility around the token has increased. However, there is a chance that MATIC will pull back.

This is because the upper band of the BB touched the price at $0.81 in the early hours of November 9. Should a retracement occur, MATIC may drop to $0.78. But it is unlikely for MATIC to drop less than $0.75 if selling pressure increases.

This inference was due to the $0.70 support formed on November 7, which bulls seemed to be defending. Meanwhile, the Awesome Oscillator (AO) indicated that a pullback may not be enough to stop MATIC’s bullish momentum.

A Bullish Momentum and a Rising Interest

At press time, the AO was 0.083. The lengthening green bars of the AO indicate that MATIC’s uptrend may accelerate. If the buying momentum continues to rise, the price of MATIC may increase by another 10% in the coming days due to the support holding at $0.70.

Another indicator supporting the bullish thesis is the Open Interest. The Open Interest is the number of outstanding futures or options contracts in the market at the end of a trading day. As of this writing, MATIC’s open interest had increased to $214.95 million.

Rising Open Interest, alongside a rising price, could serve as backing for a continuous uptrend. So, MATIC’s move above $0.90 remains feasible.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.