- A whale sent 150 million Dogecoin to the exchange as the price fell to $0.17.

- DOGE dropped below the 20 EMA, suggesting a decline to $0.14

- A buy signal appeared at $0.15 and the Open Interest indicated a possible bounce.

According to Whale Alert, 150 million Dogecoin (DOGE) worth $26.44 million, was transferred from an unknown wallet to Robinhood on March 12.

Although Coin Edition could not confirm if the 150 million coins had been sold, the deposit to the exchange suggested that liquidation was the intention.

Selling that amount of Dogecoin could be profitable considering how the coin has performed over the last few weeks. At press time, DOGE changed hands at $0.17, representing a 109.93% hike in the last 30 days. However, the memecoin’s bullish momentum has slowed down in the last 24 hours as the price traded sideways.

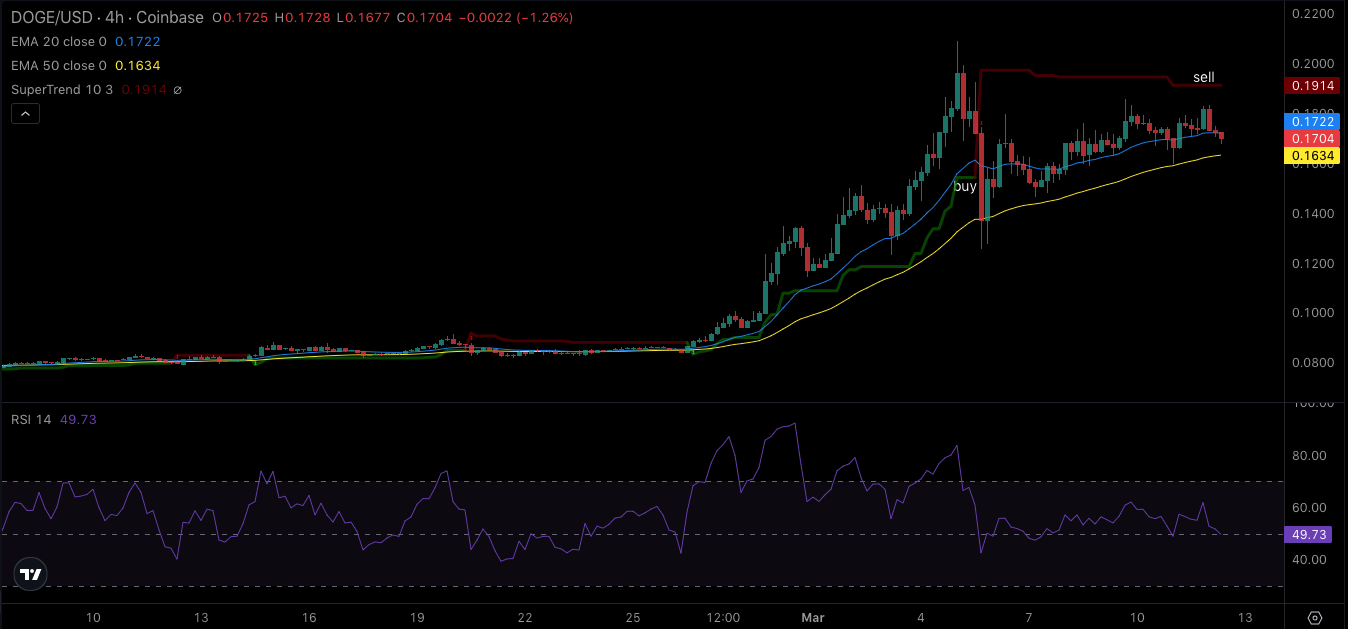

From the 4-hour DOGE/USD chart, the red candlesticks indicated that some traders had booked profits. Furthermore, the Relative Strength Index (RSI) was close to falling below the 50.00 midpoint.

If this is the case, DOGE’s bearish momentum could be confirmed and the price might slide further. Coin Edition also looked at the Exponential Moving Average (EMA).

DOGE Price Analysis

At press time, the 20 EMA (blue) was at $0.17 while the 50 EMA (yellow) was at $0.16. Although the 20 EMA had crossed over the 50 EMA, the status of the indicators alongside the price showed that Dogecoin could drop.

A close examination of the charts showed that the price had slipped below the 9 EMA, indicating a weak bullish trend. If DOGE drops below the 20 EMA, then the bearish thesis could be validated.

A highly bearish scenario could see DOGE decline as low as $0.14. However, the Supertrend indicator showed a sell signal at $0.19. But if the price falls to $0.15, it could be a good entry for short-term traders as the indicator flashed a buy signal there.

In terms of the Open Interest, Coinglass data showed that the metric declined by 1.82% in the last 24 hours. The decline in the Open Interest suggests a decrease in net positioning.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.