- Whales have been aggressively accumulating BTC and LINK so far in 2023.

- LINK’s price dropped 1.45% over the last 24 hours.

- Technical indicators for BTC signal a continuation of the current bullish trend.

Recent data by CryptoQuant and Santiment shows that whales have been accumulating Chainlink (LINK) and Bitcoin (BTC).

CryptoQuant tweeted yesterday that whales have been accumulating LINK. The crypto tracking website, CoinMarketCap, shows that LINK’s price has dropped 1.45% over the last 24 hours. As a result, LINK is trading at $6.92 at press time.

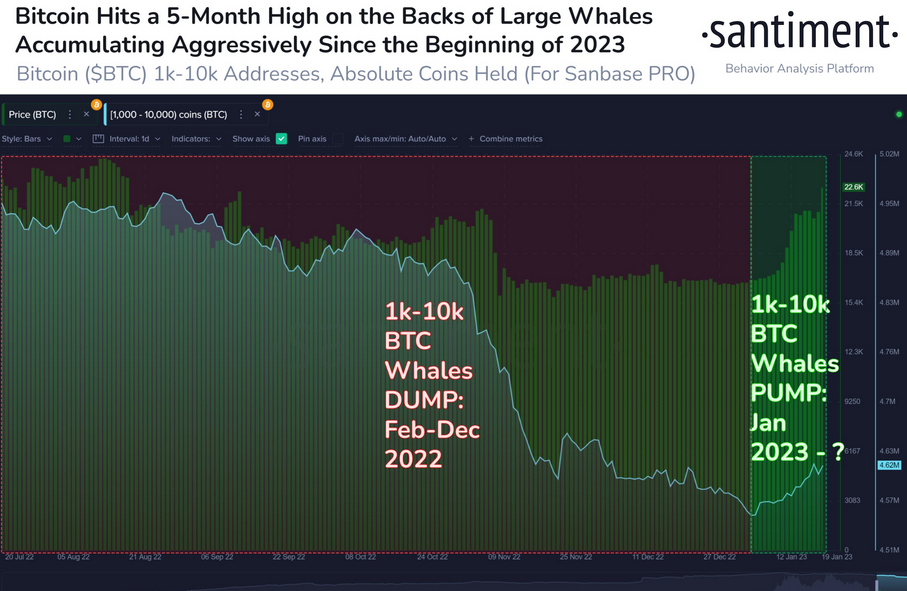

Meanwhile, CryptoBusy (@CryptoBusy) tweeted yesterday that “whales are aggressively buying more Bitcoin BTC since the beginning of 2023.” In the tweet, was a snapshot of data from Santiment.

The snapshot of the Santiment data shows that BTC’s price has hit a 5-month high as whales have aggressively accumulated the crypto market leader since the beginning of this year. The snapshot also shows that BTC whales holding between 1k-10k BTC dumped their holdings of BTC between February and December 2022.

BTC’s price is currently trading near the daily resistance level at $23,600 after it successfully flipped the resistance level at $21,550 into support.

Daily technical indicators for BTC are still bullish as the 9-day EMA is still positioned above the 20-day EMA line. In addition to this, the two EMA lines have a sleep positive slope and the 9-day EMA is breaking bullishly away from the 20-day EMA line.

The daily RSI indicator is also bullish as the daily RSI line is positioned above the daily RSI SMA line. The daily RSI line is also sloped slightly positively towards overbought territory.

Should BTC’s price break above the current resistance level at $23,600, as well as flip it into support, then it will look to target $25,150 next. On the other hand, if BTC’s price drops below the mini support at $22,680 then it will continue to drop until it hits the next major support at $21,550.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.