- Bitcoin Magazine researcher reviewed on-chain data and concluded BTC is unlikely to crash to $50K.

- The researcher observed new capital inflows absorbing BTC supplies from long-term holders.

- He noted BTC’s MVRV Z-Score sits at 2.68, indicating the market is halfway through the bull cycle.

According to Dylan LeClair, Head of Research at Bitcoin Magazine, Bitcoin is experiencing a full-fledged bull market despite recent retracement, asserting the unlikelihood of BTC crashing to $50K. LeClair expressed this sentiment in a recent post on X, updating the community on the current state of the Bitcoin market.

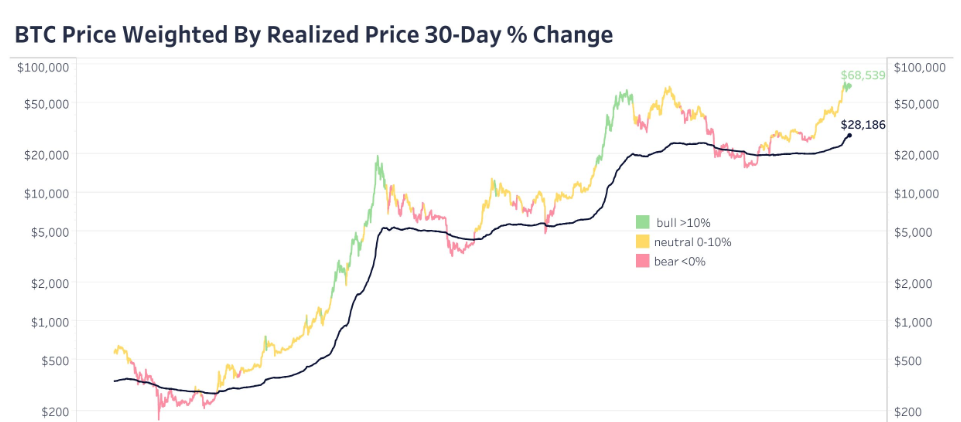

The researcher reviewed on-chain data, uncovering an interplay between long-term holders distributing their holdings and a surge of new capital inflows. One of the studied metrics was the supply distribution, particularly from Bitcoin’s realized market cap angle.

LeClair noted that Bitcoin’s realized market cap is witnessing a high positive rate of change. This metric, which reflects the value of each BTC at the price last moved on-chain, suggests that old Bitcoin holders are distributing their holdings, essentially taking profits.

Interestingly, LeClair noted that new capital inflows are impressively absorbing this supply. According to him, this phenomenon typically occurs during bullish cycles and is occurring once again.

Furthermore, LeClair noted that while past performance does not guarantee future results, historically, substantial price appreciation for Bitcoin happened during realized market cap growth, particularly above 10%.

Moreover, LeClair highlighted that Bitcoin’s Market Value to Realized Value Ratio (MVRV) Z-Score currently sits at 2.68. The researcher stated that the figure indicates the market is roughly halfway through the current bull cycle.

The analyst believes the current level, combined with the ongoing realized cap growth, suggests there is room for further growth before reaching such a peak.

Also, LeClair analyzed the derivatives market, highlighting the lowest perpetual futures open interest in Bitcoin terms in recent months. He noted the trend signifies reduced leverage and frothy speculation, further supporting a healthy bull run.

Besides, the analyst called attention to BlackRock’s recent move to update its Bitcoin ETF prospectus to include major financial institutions like Citadel, Goldman Sachs, UBS, and Citigroup. “The big boys want a piece of the action,” LeClair remarked.

The analyst concluded by drawing parallels between the current phase and the one observed in 2020 before a significant price surge. LeClair remains bullish on Bitcoin long-term, viewing it as a hedge against the inevitable debasement of traditional currencies.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.