- Bitcoin fell by 2.8% as leveraged positions unwound during thin liquidity.

- U.S. tariff threats against Europe triggered a global risk-off move.

- Investors shifted toward traditional assets as gold and silver hit record highs.

Cryptocurrency prices fell on Monday as Bitcoin dropped to $92,400. The decline followed renewed U.S.-EU tariff tensions and heavy unwinding of leveraged positions. Thin liquidity also amplified losses across digital assets.

Bitcoin Leads Crypto Sell-Off as Risk Sentiment Turns

Bitcoin fell by 2.8% over the past day, retreating from recent highs above $96,000. At the time of writing, it is trading at $92,427, eroding the gain it recorded in the past week.

The decline triggered a broad sell-off across the crypto market. Ethereum dropped nearly 4% to about $3,193, while XRP fell more than 4.6% to around $1.96. Solana slid nearly 7%, and several altcoins recorded double-digit losses. Sui and Zcash were each down about 10%, while Dash fell roughly 12% to trade near $75.

The total cryptocurrency market capitalization declined by nearly $98 billion over the past day, to about $3.22 trillion.

Trump Tariff Threats Spark Global Risk-Off Move

The downturn followed comments from U.S. President Donald Trump, who announced plans to impose new tariffs on imports from eight European countries beginning February 1.

The proposed measures include a 10% duty on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and the United Kingdom. Meanwhile, the rate is set to rise to 25% by June 1 if negotiations fail.

Trump’s tariffs followed ongoing disputes involving Greenland, a move European leaders have criticized as coercive. European Union officials signaled preparations for possible retaliation, including tariffs on U.S. imports and consideration of the bloc’s anti-coercion instrument.

The tariff announcement pressured global markets. U.S. stock futures dipped notably, with S&P 500 futures down about 0.7% and Nasdaq futures lower by roughly 1%. Meanwhile, Asian equities opened weaker, led by declines in Japan’s Nikkei index.

Liquidations Accelerate as Leverage Unwinds

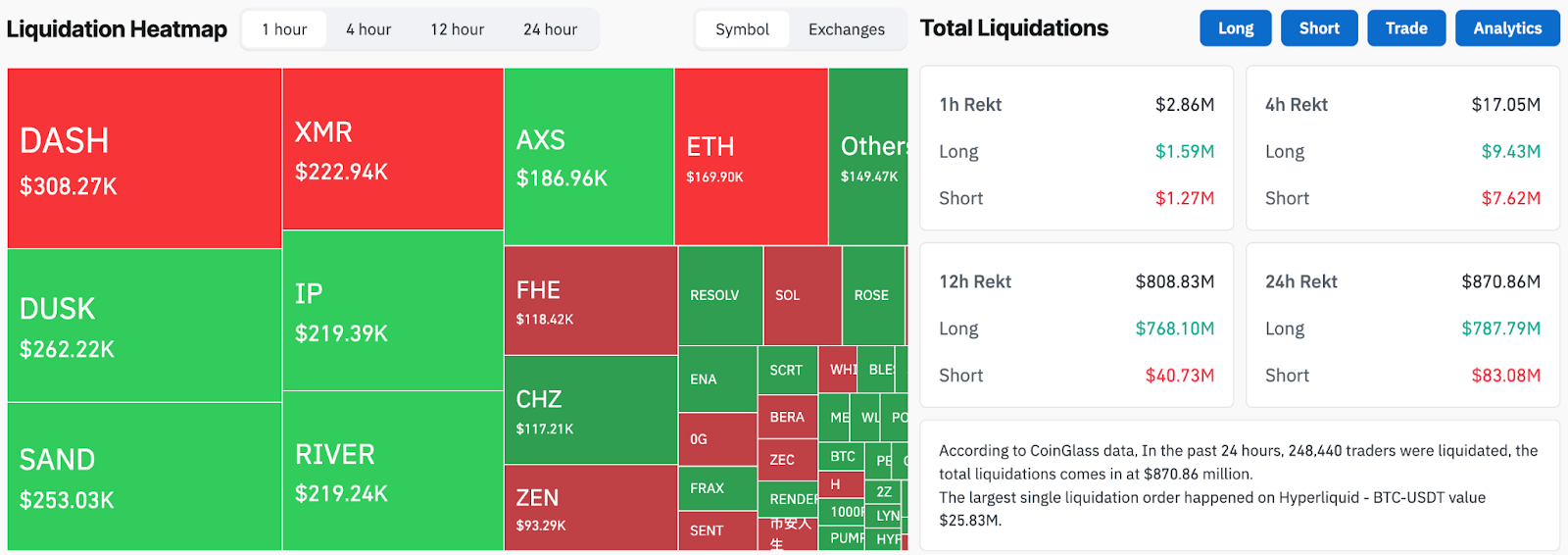

Crypto markets felt the impact quickly due to continuous trading over the weekend and into Monday’s open. According to CoinGlass data, more than $870 million worth of crypto positions were liquidated over the past 24 hours. Long positions accounted for roughly $787 million of that total.

Analysts said thin liquidity, worsened by a U.S. market holiday, magnified the sell-off once forced liquidations began.

On-Chain Data Points to Fragile Market Structure

Glassnode noted that Bitcoin’s recent advance toward $96,000 was largely driven by derivatives activity, including short liquidations, rather than sustained spot market demand. The firm said futures liquidity remains relatively thin, leaving prices vulnerable once forced buying pressure fades.

The analytics firm also highlighted a crowded supply zone formed by long-term holders who accumulated Bitcoin near prior cycle highs. That area has repeatedly limited recent rebounds.

CryptoQuant was more cautious, describing Bitcoin’s move since late November as a potential bear market rally. The firm noted that Bitcoin remains below its 365-day moving average near $101,000. At the same time, spot demand continues to contract, and U.S. spot Bitcoin ETF inflows remain modest.

Gold and Silver Hit Records as Investors Shift to TradFi

As crypto prices fell, investors moved toward traditional safe-haven assets. Gold rose more than 1.5% to a fresh record above $4,600 per ounce. Silver also reached an all-time high above $93 over the weekend while Bitcoin’s price dipped.

The contrasting performance highlighted Bitcoin’s continued tendency to trade like a risk asset during periods of macro stress. While often compared to gold, Bitcoin declined alongside equities as investors sought safety in traditional markets.

Can Bitcoin Stabilize or Will Tariff Fears Push Prices Lower?

However, some stabilization signs have emerged. Glassnode reported that long-term holder distribution has slowed compared with late 2025. Specifically, spot flows on major exchanges such as Binance show increased buyer dominance. At the same time, Coinbase-led selling has also eased.

Market participants are now watching the U.S. consumer price index data scheduled for January 22. The inflation report could shape expectations for Federal Reserve policy and influence near-term risk appetite across global markets.

Until clearer signals emerge on trade negotiations and monetary policy, analysts say Bitcoin is likely to remain sensitive to leverage, liquidity conditions, and macro headlines.

Related: US Government Says It Has Not Sold Bitcoin Forfeited in Samourai Wallet Case

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.