- XRP drops below $2, down 10.5% in 24 hours, extending its weekly loss to 16.63%.

- Whale sell-offs and weak network activity contribute to XRP’s ongoing bearish trend.

- Analysts eye support levels at $1.91 and $1.73, with deeper risks if the trendline breaks.

XRP has slipped below the critical $2 mark after a 10.5% decline in the past 24 hours, deepening its weekly drop to 16.63%. The pullback has erased earlier-year gains, leaving many holders back in negative territory.

This downturn follows weakening network activity, sustained whale sell-offs, and a market correction.

XRP Network Activity Drops to Multi-Month Lows

One of the most troubling signs for XRP is the dramatic decline in network engagement. Glassnode data shows that daily active addresses on the XRP Ledger have fallen 91% since mid-June, dropping from 577,134 to just 50,725.

New addresses have also declined significantly, falling from 13,527 on November 11 to 5,780 today.

This collapse in user activity suggests diminishing interest in the XRP ecosystem. Such declines lead to reduced trading volume, thinner liquidity, and more severe reactions to market volatility. As participation fades, price weakness intensifies.

Whales Sell 190 Million XRP in 48 Hours

Large holders have added more pressure to XRP’s slide, according to data shared by analyst Ali Martinez. Whales holding between 1 million and 10 million XRP sold 190 million coins in just 48 hours, worth roughly $402 million.

These same wallets have been trimming their exposure since early September, offloading more than 1.58 billion XRP in the past two months.

This sustained selling trend means caution among major investors. As whales exit positions, market sentiment shifts even further into bearish territory.

Crypto Market Selloff Accelerates XRP’s Decline

XRP’s downturn intensified as the broader crypto market experienced one of its sharpest corrections in months. Bitcoin slipped below $81,000, Ethereum broke under $2,700, and nearly $2 billion in liquidations rippled across digital assets.

More than 392,000 traders were liquidated within 24 hours, including a single $36.78 million BTC position. The selloff follows a stronger-than-expected U.S. jobs report, which reduced expectations of a near-term Federal Reserve rate cut.

Within two hours, the market shed $450 million in long positions, dragging altcoins lower. XRP dropped more than 10% during this period.

ETF Inflows Offer Some Relief Amid Market Turbulence

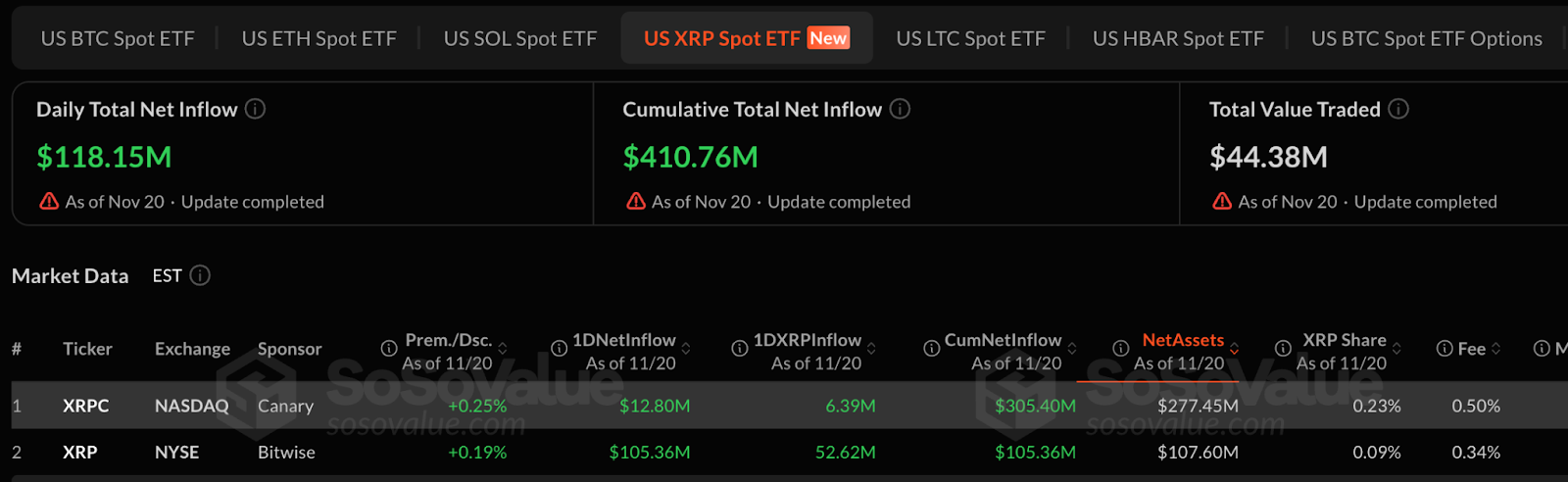

Even with the current downturn, XRP’s ETF landscape provides a pocket of stability. The newly launched Canary Capital XRP ETF (XRPC) has continued to attract steady demand.

It has posted net inflows of $292.6 million since November 13, without a single day of outflows. Bitwise XRP ETF has also joined the trend with $105 million in net inflows.

More ETFs are entering the market next week, including Grayscale’s product on November 24. Analysts believe that these new avenues for institutional investment may help offset some selling pressure and support liquidity during the correction.

How Low Can XRP Go? Analysts Identify Critical Levels

XRP has already fallen through the $2.15 support zone. Analysts now point to $1.91 and $1.73 as the next crucial regions where buyers may attempt to regain control.

Related: XRP Price Prediction: XRP Weakens as Outflows Build and OI Falls Ahead of Bitwise ETF

However, some analysts warn of a deeper structural threat. Market watcher Block Bull notes that XRP has broken below a major multi-month symmetrical triangle on the weekly chart.

If XRP cannot reclaim this structure soon, the long-term ascending trendline near $0.7 becomes the next major support. A fall to that level would represent a steep 68% correction from today’s price.

Block Bull suggests that the upcoming Franklin Templeton XRP ETF could act as a lifeline. The analyst expects significant inflows given the firm’s $1.6 trillion in assets under management, which could help counteract the current bearish momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.