- Multiple XRP ETFs launch as institutional demand accelerates.

- Grayscale and Franklin Templeton eye major November 24 debut.

- XRP price lingers near $2.10 despite heavy ETF excitement.

It has been an unusually busy stretch for XRP, and it all started with the Canary XRP ETF. The fund shocked the market by generating more than $59 million in trading volume on its first day. Since then it has continued to pull in fresh inflows, proving that traditional investors are warming up to XRP exposure faster than expected.

The First U.S. XRP Option-Income ETF Arrives

Not long after that, Amplify ETFs stepped into the spotlight with a first of its own. The firm launched XRPM, the first U.S. listed XRP option-income ETF. It targets a 3% monthly premium and around 36% annualized option income.

Others Join the XRP ETF Race

Today brought another major milestone as Bitwise will officially launch its XRP ETF. Behind the scenes, two giants are preparing their own XRP listings.Grayscale updated its S-1 filing on November 3, which triggered a 20-day automatic countdown. If the SEC stays silent, the filing becomes active on November 24. That would clear the path for listing its GXRP ETF on NYSE Arca.

Franklin Templeton has filed Form 8-A, a move that usually signals an ETF launch is close. Analyst James Seyffart says both firms could debut on the same day, setting up November 24 to be one of the biggest XRP ETF days ever.

Related: XRP Price Prediction: ETF Hype Fades As Sellers Drive Price Toward Channel Support

Yet the Price Hasn’t Moved

Despite all this progress, XRP’s price has not exploded like many expected. Just like the broader crypto market, it has been drifting lower and is currently sitting around $2.10.

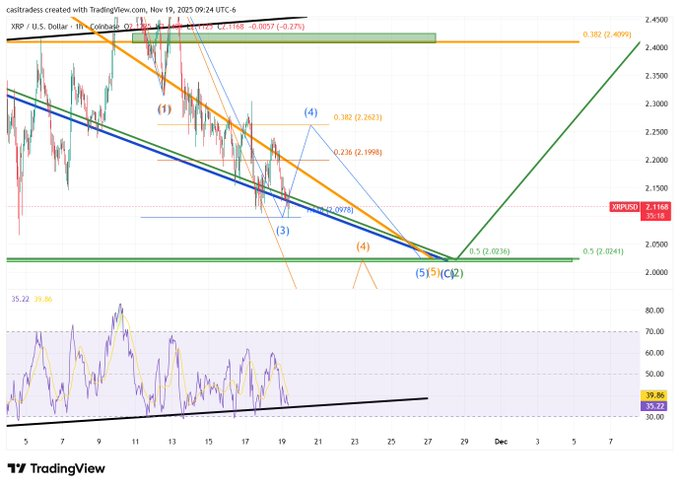

Market analyst Casi Trades said the recent sideways movement is exactly what should happen at this stage. XRP hit $2.10 and reacted from the level he expected for subwave three. RSI has also touched the support trendline, which opens the door for a bounce back to $2.26.

According to Casi, the real focus is $2.03. This level lines up with the macro 0.5 Fibonacci zone and could become the final low of XRP’s entire wave-two correction. If XRP dips to $2.03 at the same time Bitcoin retests support around $88,000, both assets could form a strong macro bottom.

A Deeper Scenario Still Exists

There is also a chance that XRP breaks below $2.03. If that happens, the next major support sits at $1.65, with possible stops at $1.84 and a retest at $2.00.

Related: XRP Flashes 3-Day Bullish Divergence as Ultimate Oscillator Hits Oversold

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.