- XRP managed to close above the weekly 21MA and recovered to $0.63.

- XRP may rise back to $0.70 if the buying momentum continues to rise.

- Traders are bullish on the price action, as indicated by the funding rate.

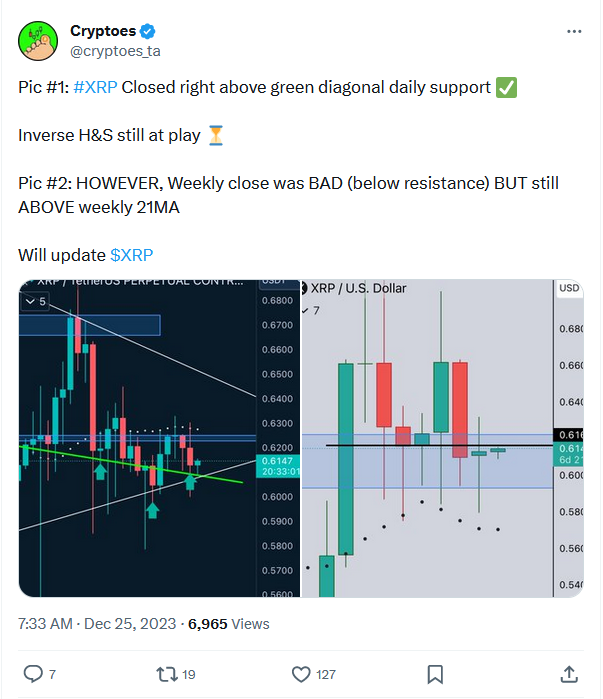

Despite Ripple’s (XRP) Head and Shoulder (H&S) structure, the weekly close was below resistance, technical analyst Cryptoes revealed. The H&S pattern is a chart formation that spots a bullish to bearish trend while indicating an upward movement is nearing its end.

Cryptoes showed that XRP had initially closed above the daily diagonal support at $0.67. However, the second image shared by the analyst indicated that the support had been lost. Nonetheless, he noted that XRP managed to close above the weekly 21-day Moving Average (MA).

XRP Rises Again

Interestingly, the weekly close of the 21MA close seemed to have helped the XRP price. At press time, the token value had increased to $0.63, a 3.15% increase in the last 24 hours. This increase made XPR outperform other cryptocurrencies including Bitcoin (BTC) and Solana (SOL) within the same period.

Another look at Cryptoes’ X profile showed that he had been monitoring XRP as he posted about a Christmas pump for the token. From the technical outlook using the Fibonacci extension indicator, XRP has the potential to build on the upswing.

A look at the 2.618 Fib level showed that XRP may reclaim $0.70 soon. However, that would require a significant change to the bullish side of things. Apart from the sentiment, a move in the $0.70 would require a surge in buying pressure from the market.

However, traders may need to approach their XRP position with caution. This is because of the indications shown by the Relative Strength Index (RSI). At press time, the buying momentum had sent the RSI reading to 67.75.

Shorts Are Not the Dominant Force

Though this is a bullish sign for XRP, it is a signal that the token may soon be overbought. Should the RSI reading tap 70.00 or above, then XRP may be back around $0.60 or $0.61. At the same time, a retracement could lay the ground for another hike if buying pressure continues thereafter.

When it comes to the funding rate, Coinglass data showed that traders’ sentiment around the token was bullish. Funding rates are fees paid between short and long-positioned traders. A positive funding rate implies that longs are paying shorts as the sentiment is bullish.

On the other hand, a negative funding rate suggests that shorts are paying longs and the sentiment is bearish. At press time, XRP’s funding rate was 0.26%—a sign that traders are positioned to make potential gains from its price increase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.