- XRP trades near $2.82, consolidating inside a descending triangle with support at $2.78 and resistance near $2.90.

- Whale outflows of $50M daily add selling pressure, mirroring past correction phases.

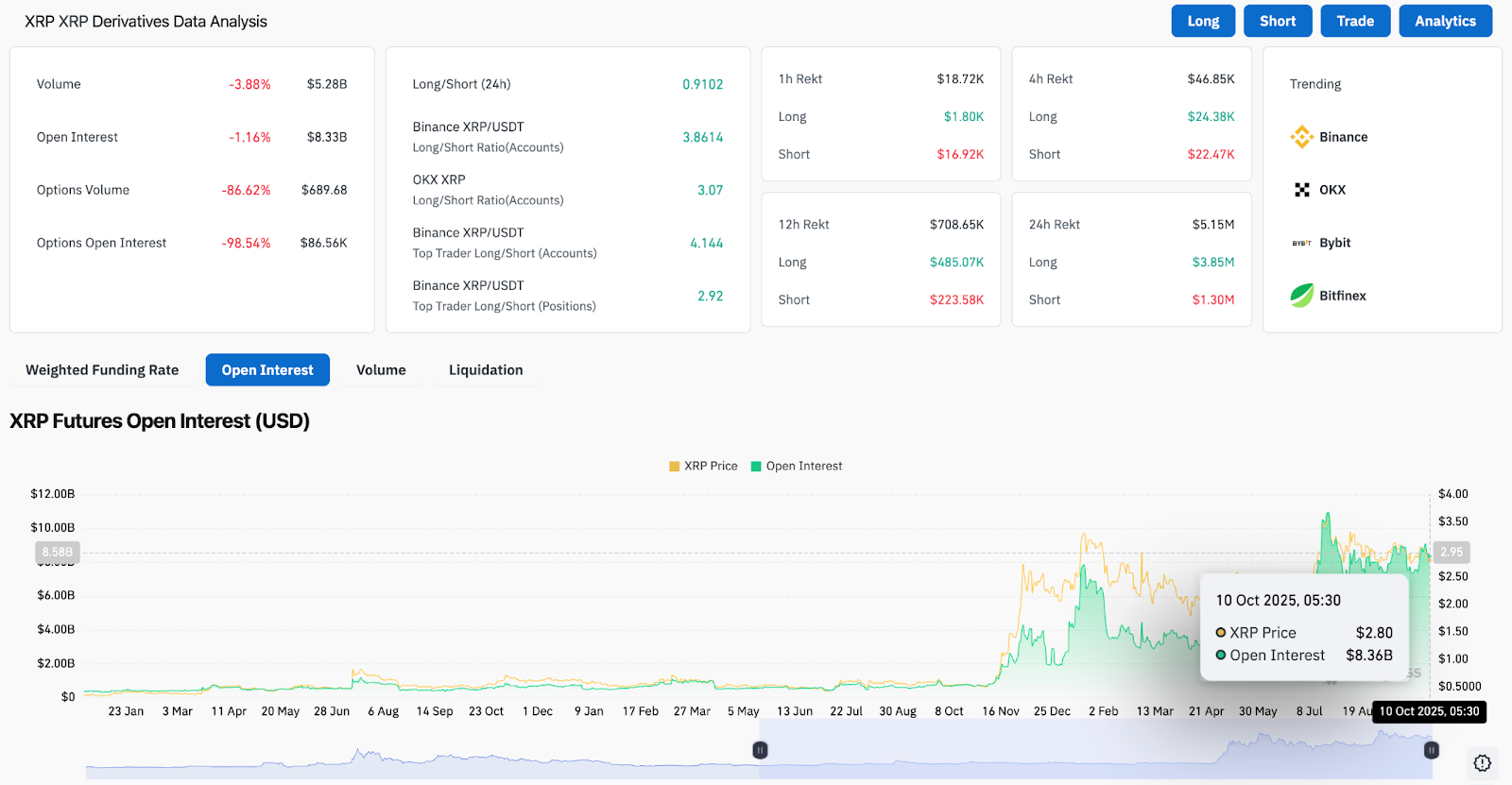

- Derivative data shows longs dominate, but muted volume and collapsing options interest cap upside.

XRP price today is hovering near $2.82, stabilizing after multiple tests of the $2.78–$2.80 support zone. The structure remains capped by a descending resistance trendline from July’s highs, while the 20-day EMA at $2.90 and the Supertrend resistance at $3.14 continue to block recovery attempts. Traders are now assessing whether this consolidation could lead to a deeper retracement or a potential reversal from critical support.

XRP Price Consolidates Below Descending Resistance

The daily chart shows XRP trading within a well-defined descending triangle, with sellers consistently defending the $2.90–$3.00 region. The 50-day EMA near $2.85 is flattening, reflecting indecision, while the 200-day EMA at $2.64 marks the last strong support before a potential breakdown.

Repeated rejections along the downtrend suggest weakening bullish momentum. RSI remains neutral near 46, and price action continues to compress between the resistance line and base support at $2.78. A decisive break below $2.78 could expose XRP to the $2.64–$2.60 zone, while reclaiming $2.92 would be the first signal of short-term recovery.

Related: Ethereum Price Prediction: ETF Flows Turn Mixed As BlackRock Accumulates

Whale Selling Adds To Market Pressure

On-chain data from CryptoQuant analyst Maartunn shows that XRP whales are offloading approximately $50 million per day, based on the 30-day moving average of whale flow. This persistent negative flow highlights continuous distribution from large holders, adding to the selling pressure observed since late September.

Historically, similar phases of sustained whale outflows have preceded short-term price corrections. The negative sentiment from large investors could limit upside momentum unless accumulation resumes.

Derivatives Data Shows Mixed Positioning

According to derivatives data on Coinglass, XRP open interest has declined 1.16% to $8.33 billion, while total futures volume slipped nearly 4% to $5.28 billion. The long/short ratio on Binance stands at 3.86, suggesting a higher concentration of leveraged longs despite soft price action.

Notably, options open interest has collapsed by over 98%, signaling waning speculative interest. The imbalance between leveraged longs and flat spot flows suggests that traders remain cautiously bullish but vulnerable to liquidations if support at $2.78 breaks.

Related: Dogecoin Price Prediction: Traders Eye $0.30 Target as DOGE Consolidates Again

Broader Market Sentiment Remains Neutral

While broader crypto sentiment has stabilized with Bitcoin holding above $108,000, XRP’s relative weakness stands out amid declining whale inflows and tepid derivatives demand. Futures open interest remains elevated but stagnant, reflecting a market in wait-and-see mode.

Traders are watching whether the $2.80 area continues to attract defensive bids. If volume fails to confirm a rebound, XRP could remain trapped in this compression phase through mid-October.

Technical Outlook For XRP Price

Key levels to watch for XRP price today:

- Upside: $2.92 (20-day EMA), $3.10 (supply zone), $3.23 (Supertrend flip).

- Downside: $2.78 (support floor), $2.64 (200-day EMA), $2.50 (trend base).

- Momentum zone: RSI 45–50, neutral bias until a breakout or breakdown confirms direction.

Outlook: Will XRP Go Up?

The near-term outlook for XRP price prediction hinges on whether bulls can reclaim the $2.92–$3.00 resistance cluster before bearish momentum extends below $2.78. Whale selling and muted derivative inflows continue to weigh on sentiment, while the broader crypto market remains directionally flat.

Analysts believe the $2.64 level will determine whether this phase becomes a deeper correction or a re-accumulation base. A close above $3.00 could open a path toward $3.23 and $3.35, but failure to defend $2.78 would likely invite a retest of $2.60 in the short term.

For now, XRP price action remains in consolidation, awaiting a clear catalyst to break out of its descending structure.

Related: Litecoin Price Prediction: Traders Bullish on LTC as ETF Optimism Fuels Momentum

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.