- XRP holds firm above key EMAs, signaling strong bullish market structure

- Rising open interest points to higher volatility and potential breakout setup

- Exchange outflows highlight accumulation trend and shrinking available supply

The XRP market is showing renewed strength as buyers defend key support near $2.45 following a multi-week recovery from the $1.39 low. The recent rebound has not only reclaimed important Fibonacci levels but also positioned XRP above critical moving averages.

This technical setup signals growing confidence among traders anticipating a potential continuation toward the $3.00 zone. As market data suggests rising speculative participation, the outlook for XRP appears constructive in the short term.

Strength Builds Above Key Support Levels

XRP currently trades around $2.64, holding firm above the 20-day and 50-day exponential moving averages at $2.61 and $2.56, respectively. The token also tests the 100-day EMA near $2.63, which acts as a short-term pivot for bullish momentum. Maintaining stability above these averages confirms improving strength in the market structure.

Related: Solana Price Prediction: SEC ETF Approval Sets Stage For $225 Breakout

The $2.45 mark, aligned with the 61.8% Fibonacci retracement, now represents solid support. A failure to sustain this area could invite a retest toward $2.25 or even $2.05.

However, consistent closes above $2.74 the 78.6% Fibonacci level could pave the way for a move toward $3.10, the previous swing high. The $2.80–$3.00 range remains an important profit-taking zone and may cap gains temporarily before any further advance.

Rising Open Interest and Volatility Expectations

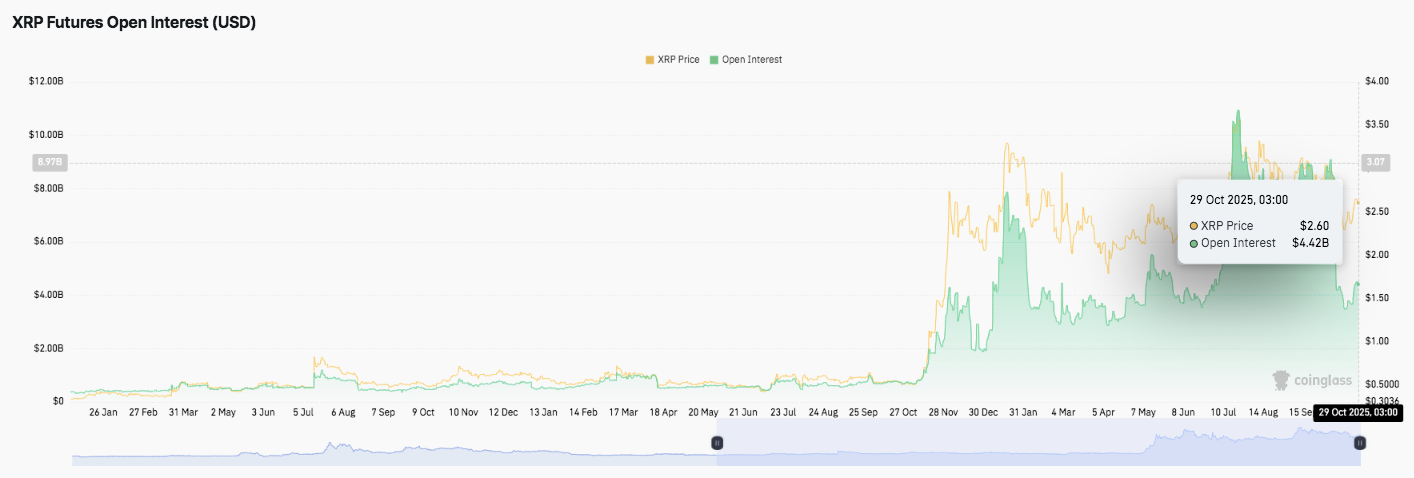

XRP’s futures open interest has grown significantly since August, reflecting increased trading activity and renewed investor interest. Data from Coinglass shows that open interest surged to $4.42 billion by October 29, up from under $1 billion two months earlier. This jump in leveraged exposure signals higher participation from speculative traders and institutional desks.

Consequently, volatility may rise as larger positions increase the risk of sharp swings. Such expansions in open interest often precede major directional moves. Hence, traders are watching for either a breakout above $2.74 or a breakdown below $2.45 to define the next major trend.

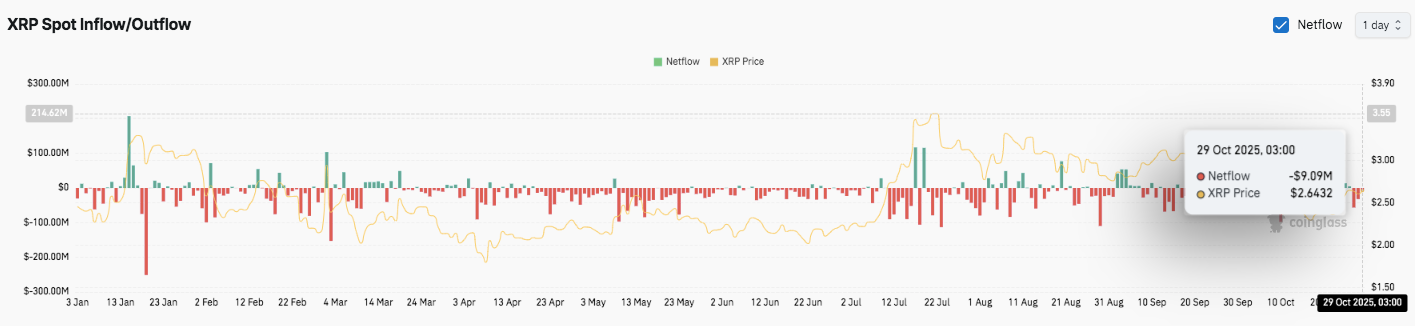

Exchange Outflows Indicate Long-Term Holding Behavior

Exchange data reveals consistent outflows of XRP since February, suggesting accumulation by long-term holders. A net outflow of $9.09 million was recorded on October 29 while the token traded near $2.64. This declining exchange supply often supports bullish setups, as reduced liquidity can amplify price reactions to demand spikes.

Related: Bitcoin Price Prediction: BTC Price Consolidates as Open Interest Hits $73B

Technical Outlook for XRP Price

Key levels remain clearly defined heading into November.

- Upside levels: $2.74 (78.6% Fib), $2.90, and $3.10 as near-term hurdles. A breakout above $2.74 could extend gains toward the $3.10–$3.25 zone, the next major resistance cluster.

- Downside levels: $2.45 (61.8% Fib) trendline support, followed by $2.25 and $2.05 as secondary retracement levels.

- Resistance ceiling: $2.80–$3.00 (200-day EMA) remains the critical zone for reclaiming medium-term bullish control.

The technical setup shows XRP consolidating in a tightening range above $2.45, signaling compression before a potential volatility expansion. A decisive move beyond $2.74 could trigger an acceleration phase toward $3.10, completing a full Fibonacci retracement of the prior correction.

Will XRP Extend Its Recovery?

XRP’s near-term trajectory depends on whether bulls can defend the $2.45 support and sustain closes above the 20- and 50-day EMAs. A successful breakout above $2.74 could attract momentum traders and ignite a run toward $3.10 or even $3.25 if inflows continue. Conversely, a failure to hold $2.45 might signal a pullback toward $2.25 or $2.05, resetting bullish momentum before the next leg higher.

For now, XRP remains in a constructive accumulation phase, supported by strong open interest and consistent exchange outflows. The November outlook favors a bullish continuation, provided buyers maintain control above $2.45 and reclaim the $2.80–$3.00 resistance ceiling with volume confirmation.

Related: Official Trump Price Prediction: TRUMP Eyes $10 Target On Speculative Rotation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.