- XRP price today trades near $3.08, with resistance at $3.20 and support around $2.95–$2.83.

- U.S. and U.K. government pilots with Ripple technology boost the long-term adoption narrative.

- XRP price prediction points to $3.30–$3.46 if buyers reclaim momentum above key Fibonacci levels.

XRP price today is trading near $3.08, easing after testing resistance at the $3.10–$3.20 zone. The immediate focus is whether buyers can push price above the Fibonacci 0.5 retracement at $3.19 or if sellers will drag XRP back toward the $2.95–$2.83 support cluster.

XRP Price Holds Key Fibonacci Levels

The daily chart shows XRP consolidating inside a descending triangle pattern capped by the $3.20 ceiling. Support rests around $2.99, aligned with the 20-day EMA, while the 100-day EMA at $2.83 provides a deeper safety net.

RSI is neutral at 53, suggesting neither bulls nor bears hold dominance. A break above $3.20 would expose higher levels at $3.30 and $3.46, while failure to hold $2.95 could reopen downside risk toward $2.83 and the 200-day EMA at $2.58.

U.S. And U.K. Collaboration Fuels Narrative

A major catalyst emerged after reports highlighted U.S. and U.K. government pilots with Ripple for cross-border payment testing. The Bank of England is assessing XRP’s infrastructure for settlements, while the U.S. Federal Reserve’s FedNow system is reportedly tied to Ripple technology.

This narrative has fueled optimism that XRP could gain a stronger role in institutional payment rails. Market participants view government collaboration as a credibility boost, potentially accelerating adoption if trials succeed.

Derivatives Data Highlights Caution

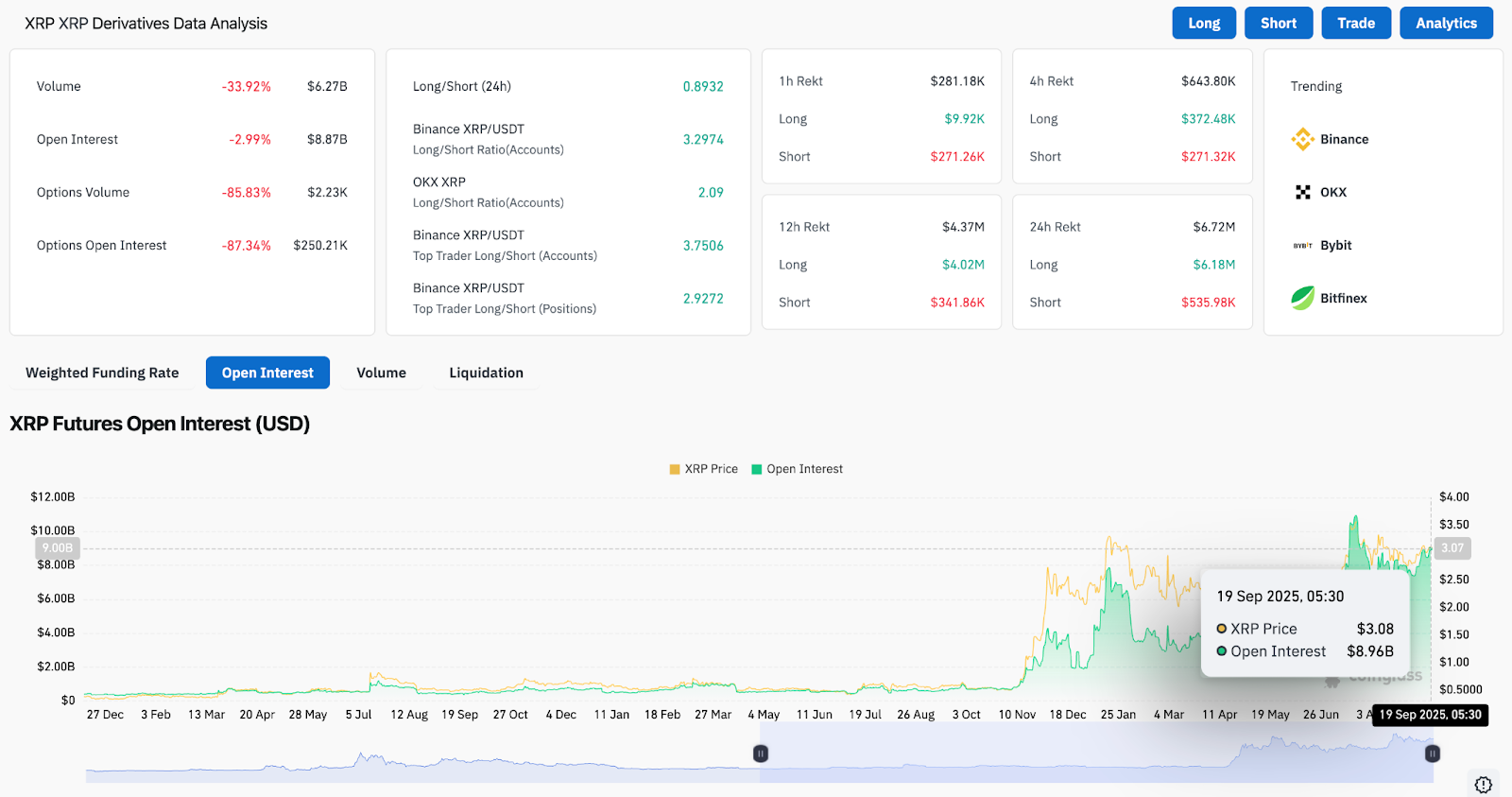

Despite strong headlines, derivatives positioning shows caution. XRP’s futures open interest sits near $8.96 billion, down about 3% in the past 24 hours. Options volume and open interest also saw sharp declines, underscoring reduced speculative activity.

Funding rates remain balanced, and long-short ratios show traders leaning slightly bullish across Binance and OKX. However, with daily trading volume down 34%, XRP price action may lack the liquidity needed for a sharp breakout unless inflows rise.

Technical Outlook For XRP Price

XRP price prediction for the short term hinges on the $3.20 resistance and $2.95 support.

- Upside levels: $3.20, $3.30, and $3.46 if buyers gain momentum.

- Downside levels: $2.95, $2.83, and $2.58 as near-term defenses.

- Trend support: $2.71 remains the broader accumulation floor if selling pressure intensifies.

Outlook: Will XRP Go Up?

XRP price action remains rangebound, with buyers watching for a breakout above $3.20 to confirm bullish continuation. Government testing of Ripple’s network has created a strong long-term narrative, but derivatives data shows traders remain cautious in the short run.

As long as XRP holds above $2.95, analysts maintain a moderately bullish view. A decisive close above $3.20 could accelerate gains toward $3.46, while losing $2.95 would shift focus to $2.83 and the 200-day EMA at $2.58. For now, XRP sits at a technical crossroads where fundamentals and flows must align to sustain upside momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.