- XRP holds critical $2.80 support as traders await ETF decisions and market clarity.

- Rising futures open interest signals strong speculative positioning despite spot outflows.

- ETF ruling window could shift XRP sentiment, triggering breakout above $2.94 resistance.

XRP’s recent price action reflects a market in suspense. After hitting a strong rejection at the $3.08 level, the cryptocurrency has entered a corrective stage, finding temporary support at the $2.80 level. This area corresponds with the 0.236 Fibonacci retracement zone and represents an area where buyers are cautiously defending support.

Despite the pressure, traders are still looking at technical signals that could reveal the next decisive move, especially with windows for a ETF ruling around the corner, which is likely to impact the sentiment in the market.

Market Structure and Technical Indicators

The 4-hour chart shows that XRP still trades below important exponential moving averages (EMAs), with the 20, 50, 100, and 200-period lines concentrating within the range of $2.89 to $2.93. This proximity highlights a narrowly clustered range. Notably, the 20 EMA has fallen below the 50 EMA, which indicates temporary downward bearishness.

Nevertheless, the capability of XRP to retain above $2.80 is critical. A loss below this level may spread the losses up to the September swing low of $2.70. On the other hand, a bounce of more than $2.94 would restore short-term bullish trend and leave a pathway toward $2.99 and $3.08.

Related: Shiba Inu Price Prediction: Analysts Eye $0.000014 Recovery As Holder Count Surges

Capital Flows and Derivatives Sentiment

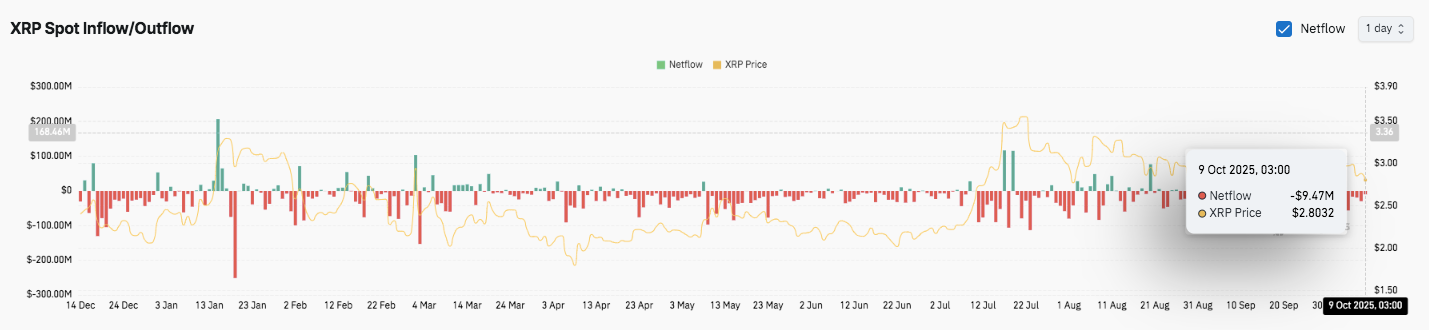

Beyond technicals, fund flow data paints a cautious picture. On October 9, XRP recorded a net outflow of $9.47 million, continuing a multi-month trend of investors reducing exposure since mid-July.

Earlier in the year, inflows had exceeded $200 million during rally phases in January and July, but enthusiasm has since cooled. This persistent outflow indicates profit-taking among short-term traders while long-term holders appear content to wait out the consolidation.

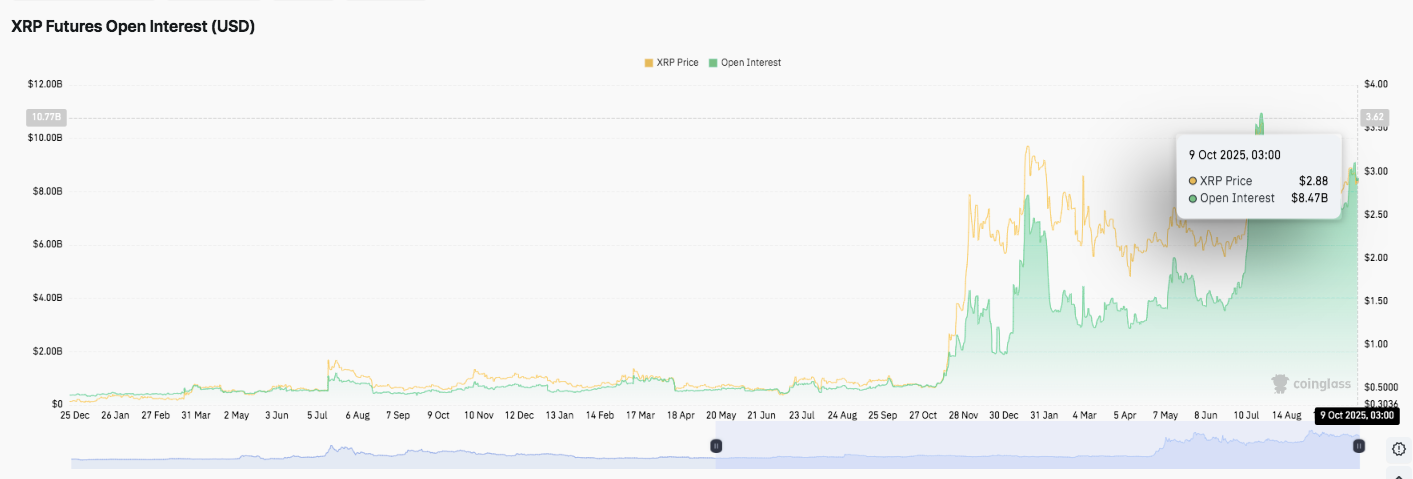

Meanwhile, the futures market tells a different story. Open interest has surged to $8.47 billion, its highest in months. The steady rise from under $2 billion earlier in the year suggests that speculative interest remains strong. This combination of cautious spot flows and aggressive derivative positioning points to growing anticipation of volatility.

ETF Decisions Could Define the Next Trend

All eyes now turn to the October 18–25 window when regulators will decide on six spot XRP ETF applications. The list includes major players such as Grayscale, Bitwise, and WisdomTree.

Even a partial approval could reflect Bitcoin’s rally following the ETF launch, unlocking new institutional inflows. However, even though XRP’s short-term bias is still bearish, a positive call can quickly flip sentiment and push the asset back in the direction of the $3.18 resistance zone.

Related: Solana Price Prediction: ETF Staking Twist And 95% Stock Volume Lead Build Momentum

Technical Outlook for XRP Price

Key levels remain well-defined heading into mid-October:

- Upside levels: $2.88 (0.382 Fib), $2.94 (EMA cluster), and $2.99 as immediate hurdles. A breakout beyond $2.99 could pave the way for a retest of the $3.08 resistance zone and potentially $3.18 if momentum accelerates.

- Downside levels: $2.81 (0.236 Fib) serves as immediate support, followed by $2.70 and $2.69 the September swing low. A sustained close below $2.80 may expose XRP to deeper retracement pressures toward $2.60.

- Resistance ceiling: The $2.94–$2.96 region, aligning with the 200-period EMA, remains the key level to flip for medium-term bullish continuation.

The technical framework indicates that XRP is consolidating in a wide range of $2.69 to $3.18, with a slight bearish bias as long as it remains below the 200 EMA line. However, the tightening of price compression near the base of $2.80 shows a buildup in volatility.

Will XRP Rise Again?

XRP’s October path depends on buyers being able to hold the $2.80-$2.81 zone in the face of steady profit-taking. A breakout above $2.94 may ignite a new wave of buying interest, fueled by increasing futures open interest and anticipation for upcoming ETF decisions. On the flip side, if they break through $2.80, it might strengthen the corrective wave, driving XRP down to $2.70 before any recovery attempt.

Related: Ethereum Price Prediction: ETH Holds Key Fibonacci Level Ahead of Fusaka Upgrade

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.