- XRP trades near $2.13, sliding deeper inside the descending channel despite nine ETF launches this week.

- Spot outflows stay negative, with $1.33M exiting exchanges as traders unwind exposure ahead of catalyst week.

- $2.10–$2.02 remains critical support, with recovery only possible if XRP reclaims $2.31 and breaks the 20 EMA.

XRP price today trades near $2.13 after sliding more than 3 percent in early Tuesday trading. The market continues to sit inside a descending channel that has guided every lower high since July, while sellers lean on the EMA cluster and spot outflows remain persistent. The upcoming lineup of nine XRP ETFs has increased speculation, but flows show traders are still unwinding exposure despite the headlines.

Downtrend Holds As XRP Rejected At EMA Cluster

The daily chart shows XRP pinned beneath the 20, 50, 100, and 200 EMAs at $2.31, $2.46, $2.58, and $2.64. Every attempt to reclaim these moving averages has been rejected, including the recent bounce toward $2.31 that failed at the descending trendline.

XRP remains inside a clean falling channel. Price has made a sequence of lower highs at $3.24, $2.92, and $2.70, each forming near key Fibonacci zones. The latest rejection came directly beneath the 0.382 retracement at $2.47, reinforcing seller control.

Related: Ethereum Price Prediction: ETH Faces Pressure as Outflows Rise and Channel Downtrend Deepens

Supertrend flipped red at $2.64 and has not turned positive since. As long as price stays below the 20 EMA, the setup favors continued lower-lows inside the channel.

The next structural support on the daily chart sits at $2.02 to $1.95, which aligns with the lower boundary of the channel and the midpoint of the wide red Fibonacci zone.

Outflows Continue Despite Nine ETF Launches

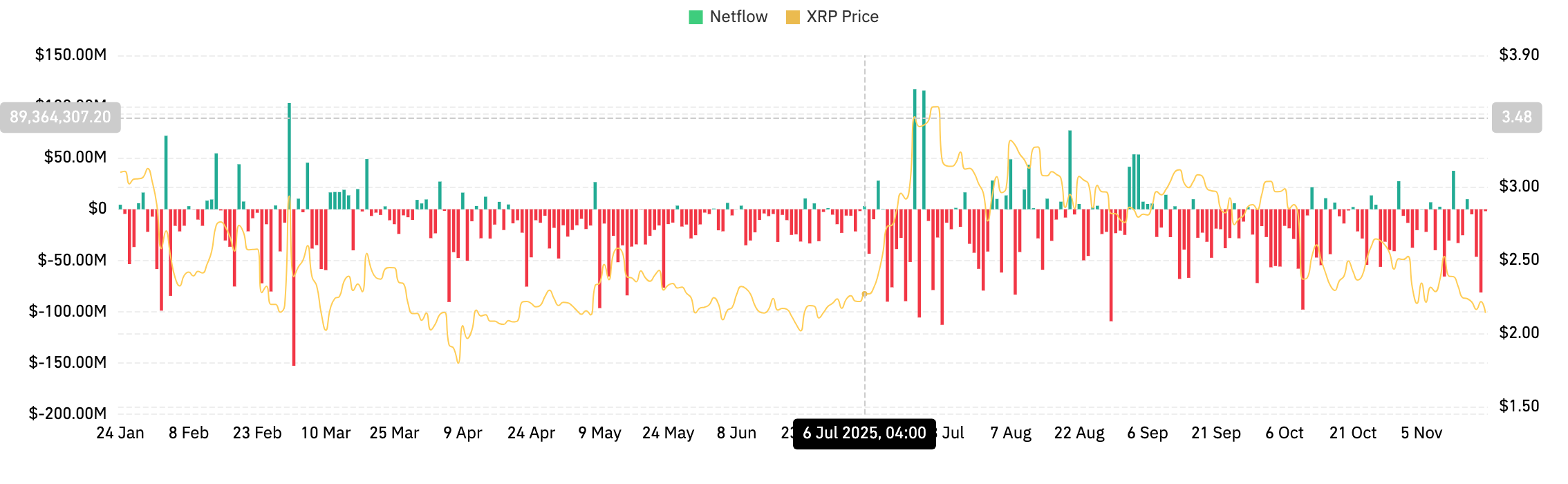

Coinglass spot flow data shows another $1.33 million net outflow recorded on November 19. This continues a pattern that has dominated the market for months, with red outflows crowding the chart. XRP has rarely seen sustained inflow periods since early August.

The lack of accumulation is notable given the upcoming ETF lineup. A post from John Squire highlights nine XRP ETFs scheduled for November 18 to November 25, including filings from Franklin Templeton, Bitwise, 21Shares, CoinShares, and Grayscale. These issuers typically generate attention and speculation, yet spot flows are not showing early positioning from larger traders.

This divergence between narrative excitement and actual demand is keeping sentiment cautious. Without improvement in spot flows, ETF-driven upside may face resistance.

Intraday Pressure Mounts As Price Fails To Hold VWAP

On the 30-minute chart, XRP trades below all VWAP bands at $2.17, $2.19, and $2.14. The last attempt to reclaim the session VWAP at $2.17 failed, causing another leg lower toward the intraday support zone at $2.12 to $2.10.

Related: Pi Price Prediction: PI Price Holds Mid-Range as Traders Track Upcoming Unlocks

RSI sits near 35, signaling weak momentum after repeated failures at the upper VWAP band. Sellers continue to fade every bounce, using the downward sloping VWAP structure as an active barrier.

The intraday trend will only stabilize if XRP regains the VWAP mid-band near $2.17. Until then, price remains vulnerable to lower channel targets.

Outlook. Will XRP Go Up?

The ETF catalyst has potential, but price action and flows continue to favor sellers.

- Bullish case. A strong reclaim of $2.31 is the first requirement. This level sits at the 20 EMA and marks the bottom of the recent rejection zone. A breakout above $2.47 would confirm momentum, allowing XRP to challenge $2.70 and then $2.92 if flows shift to inflows and VWAP structure turns supportive.

- Bearish case. A daily close below $2.10 exposes the channel low at $2.02. Losing $2.02 opens the door toward $1.95 and then $1.75, where the next major Fibonacci support sits.

If XRP reclaims $2.31 with improving flows, the outlook stabilizes. Losing $2.10 confirms continuation toward deeper support.

Related: Starknet Price Prediction: STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.