- XRP experienced a resurgence in whale transactions exceeding $1 million.

- Wallets containing 10 million XRP now hold 67.2% of supply, the highest since 2022.

- Santiment didn’t observe panic actions originating from XRP whales, another bullish signal.

Market intelligence platform Santiment has spotted a potential bullish signal for XRP as new key indicators align, suggesting XRP exhibits a promising potential for a rebound. Santiment called attention to the bullish sign in a recent update regarding XRP on X.

The platform provided comprehensive insights into the current dynamics of the XRP market, utilizing on-chain data analysis. First, Santiment noted that XRP was at risk of falling below the psychological $0.5 price mark.

The platform disclosed that a dip below the threshold would mark its first instance since October 2023. Interestingly, this forecast has come to fruition as data shows that XRP’s current price is $0.4909.

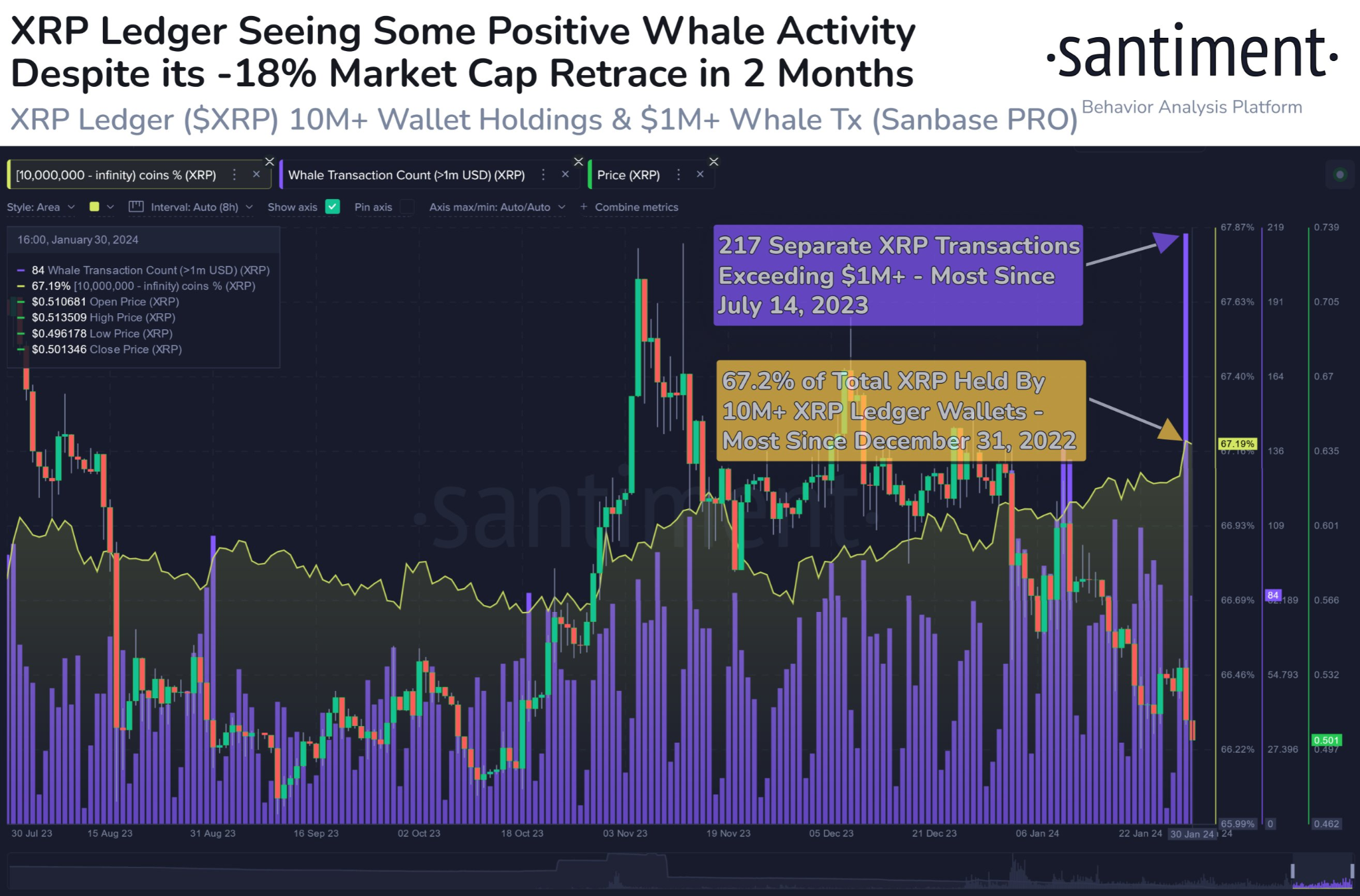

Meanwhile, Santiment revealed that on January 31, the XRP network experienced a resurgence in XRP whale transactions, which are transactions involving monetary values exceeding $1 million. Per the update, yesterday’s milestone represented the first notable surge in XRP whale transactions in the past seven months.

Interestingly, this closely coincided with the U.S. federal court’s ruling that XRP is not a security. Santiment noted the new trend has resurfaced, with 217 distinct XRP transactions of over $1 million observed on January 31.

Moreover, Santiment underscored that they have not observed any panic actions originating from XRP whales. Furthermore, the platform noted that, as of yesterday, wallets containing at least 10 million XRP collectively held 67.2% of the available supply. Importantly, this percentage represents the highest since December 31, 2022.

Ultimately, Santiment proclaimed that several key signals indicate that XRP stands out as one of the stronger candidates for a rebound in the coming days. However, it emphasized that XRP’s rebound hinges on Bitcoin stabilizing throughout the week.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.