- Zcash maintains bullish momentum as price structure forms higher highs and lows

- Rising open interest shows traders’ confidence and signals potential price volatility

- On-chain inflows and reduced exchange withdrawals confirm renewed investor accumulation

Zcash (ZEC) continues to attract market attention as it sustains a strong bullish setup, supported by both technical indicators and increasing investor activity. The cryptocurrency has maintained its upward trajectory since rebounding from the $120 region, showing a consistent pattern of higher highs and higher lows. This technical formation suggests that the bullish trend remains intact, with traders closely watching whether ZEC can clear its next resistance zone near $375 to confirm further upside.

Price Structure and Technical Outlook

ZEC is currently trading near $356, maintaining its position above critical short-term supports. The 20-EMA sits around $331, while the 50-EMA holds near $305, both acting as reliable dynamic support zones.

Moreover, the Fibonacci retracement drawn from the $122 swing low to the recent $375 peak highlights important demand regions at $278, $249, and $219. These levels align with historical accumulation areas, suggesting strong buying interest if prices retrace.

Consequently, analysts note that the 20-, 50-, 100-, and 200-EMAs remain positively stacked, confirming bullish momentum. A sustained close above $375 could open the path toward the $400–$420 range. Conversely, a drop below $331 might trigger a short-term pullback toward $305 or $278, where fresh buying pressure could reemerge.

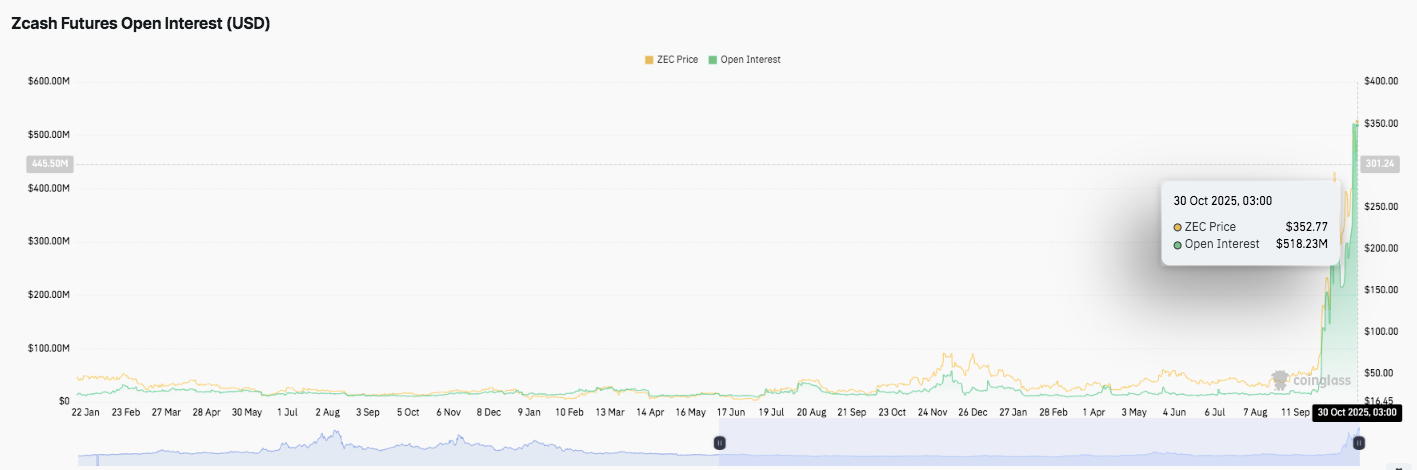

Market Sentiment Strengthens with Rising Open Interest

Investor optimism appears to be increasing, reflected by a sharp rise in Zcash futures open interest. As of October 30, open interest has reached approximately $518 million — its highest level in more than a year.

Related: Cardano Price Prediction: ADA Risks Breakdown As $25M Outflows Clash With Leios Milestone

This jump represents a fivefold increase from earlier 2025 levels, when activity remained subdued below $100 million. The trend signals a renewed influx of leveraged positions and heightened speculative participation, often preceding major price swings.

Hence, this surge in derivative exposure suggests traders are positioning for potential volatility and sustained upside movement, reinforcing bullish sentiment across the ZEC market.

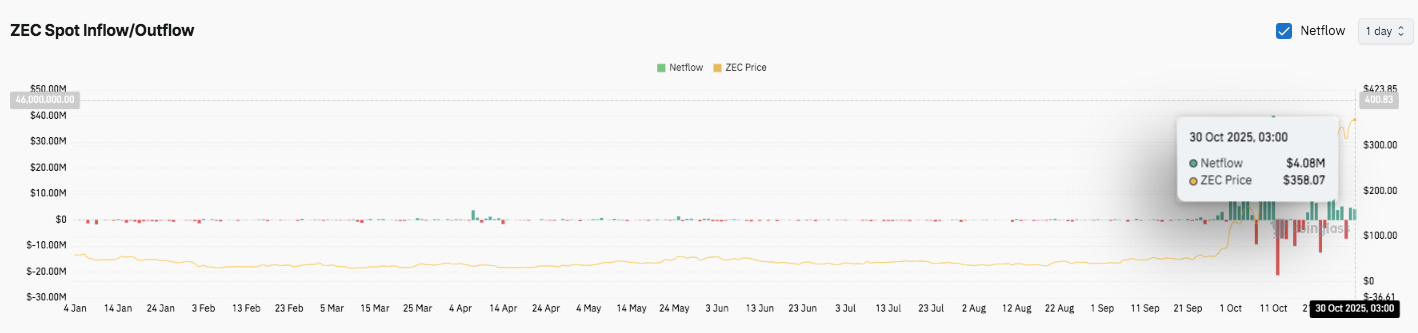

On-Chain Flows Indicate Renewed Accumulation

Besides derivatives activity, Zcash’s on-chain metrics also reflect a turnaround in investor behavior. Net inflows surpassed $4 million on October 30, signaling a decisive shift from the extended outflow period seen between September and mid-October. Moreover, exchange withdrawals have slowed, hinting that investors are holding their positions in anticipation of continued gains.

Technical Outlook for Zcash (ZEC): Key Levels Remain Crucial Heading Into November

- Upside levels: $375, $400, and $420 serve as immediate resistance zones. A breakout beyond $420 could open the path toward $465 and $500.

- Downside levels: Initial support sits near $331 (20-EMA), followed by $305 (50-EMA) and $278 (Fib 0.618 retracement). A sustained break below $278 could invite a deeper pullback toward $249 or $219.

- Resistance ceiling: $375 remains the major level to flip for medium-term bullish continuation. A confirmed close above this zone would validate renewed upside strength.

The broader chart structure shows ZEC consolidating within an ascending channel formed since the $120 base earlier in 2025. The EMAs (20 > 50 > 100 > 200) remain positively aligned, reinforcing the existing uptrend. Momentum indicators suggest a mild cooling phase after recent highs, but structure remains intact.

Will Zcash Extend Its Rally?

Zcash’s price action heading into November hinges on whether bulls can defend the $331–$305 range while maintaining strong derivatives participation. Sustained inflows and rising open interest indicate that momentum may rebuild quickly once $375 is cleared. A decisive breakout above this zone could push ZEC toward $420 and potentially $465 in the weeks ahead.

Related: Solana Price Prediction: SEC ETF Approval Sets Stage For $225 Breakout

Conversely, failure to hold above $305 may expose the asset to deeper corrections near $278 or even $249, where long-term buyers could re-enter. Overall, ZEC remains in a bullish structure, and its next move will depend on how well it consolidates before the next volatility expansion phase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.