- Santiment tweeted that something is brewing for LINK following 3 large and quick whale transactions.

- Friday’s transactions all took place within 11 minutes from each other.

- The altcoin’s price has risen 1.08% over the last 24 hours.

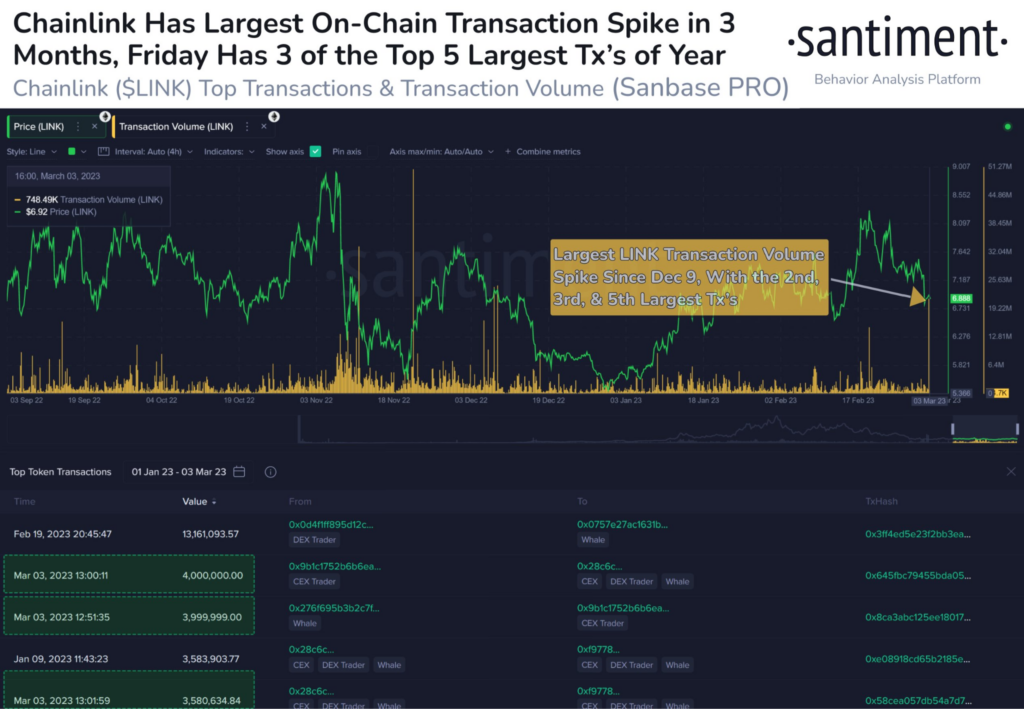

Santiment, the blockchain analytics firm, tweeted this morning that there may be something brewing with Chainlink (LINK). On their official Twitter page, @santimentfeed, the analytics firm shared that there were 3 big whale transactions made with LINK. The tweet also added that these transactions took place 11 minutes from each other during Friday’s final hours.

According to the tweet, the total dollar amount transacted in these 3 transactions is estimated to be around $79.7 million.

Friday’s transactions, which saw a total of 11.6 million LINK moved, are 3 of the 5 biggest transactions for 2023, according to Santiment’s data.

These whale transactions seemed to have had a positive effect on LINK’s price. CoinMarketCap shows that LINK’s price has risen 1.08% over the last 24 hours. Furthermore, LINK has also strengthened against the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH), by 1.13% and 0.84% respectively. As a result, the price of LINK stands at $6.92 at press time.

LINK is trading in the consolidation channel between $6.767 and $6.975. LINK’s price attempted to break out above the consolidation channel over the last 24 hours but was rejected by the resistance level shortly after making the move to close the 4-hour session at $6.915.

LINK’s price has a lot of technical obstacles to overcome before traders should look to enter a long position for LINK in the coming 24-48 hours. The first obstacle is the upper bound of the aforementioned consolidation channel. The next obstacle is the 9 EMA line on LINK’s 4 hours chart which is currently acting as a resistance level for the altcoin’s price.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.