- Some owners of Bored Ape Yacht Club NFTs who pledged them as security for ETH loans have defaulted.

- The loan has a 48-hour grace period before liquidation kicks.

- The floor price of BAYC has dropped from 153.7 ETH in May to 69.69 ETH in August.

Many owners of valuable Bored Ape Yacht Club (BAYC) and CryptoPunks NFTs who pledged them as security for loans in Ethereum (ETH) have defaulted on their obligations. The scenario could result in the first significant mass liquidation event in the NFT industry.

There are currently 32,267 ETH ($59,048,610) worth of NFTs being used as collateral for loans on BendDAO alone

For the first time ever, a lot of these are at serious peril of liquidation

A thread on the single biggest risk to the NFT market that nobody is talking about

— Cirrus (@CirrusNFT) August 17, 2022

To repay its loans, lending service BendDAO may liquidate up to $55 million in NFTs, according to Twitter crypto influencer DoubleQ.

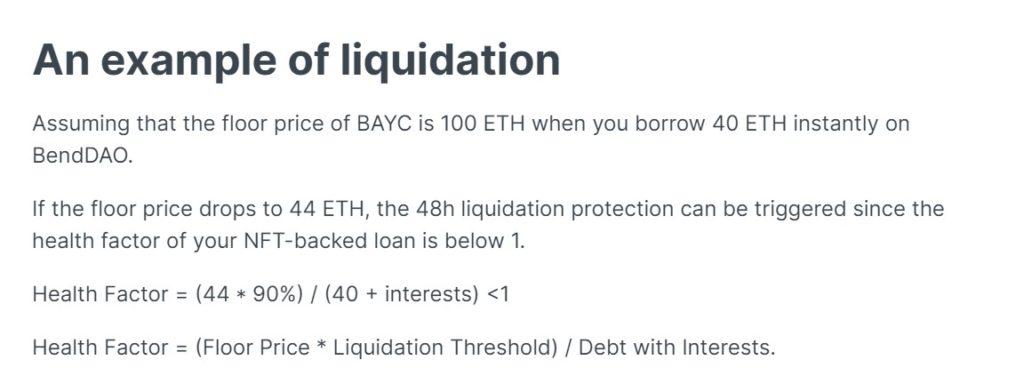

Notably, the floor price of an NFT collection plays a crucial role in defining the health factor. Loans from BendDAO range from 30% to 40% of the NFT’s floor price. However, if the NFT’s floor price approaches the borrowed amount too closely, a liquidation threshold, the protocol sells the NFT.

Interestingly, the floor price of BAYC has dropped from 153.7 ETH in May to 69.69 ETH in August, an almost 55% decrease in just three months. In parallel, data from BendDAO reveals that the health factor of at least 20 loans with BAYC as collateral has fallen to 1.1.

The loan has a 48-hour grace period, after which the borrower’s NFT collateral will be liquidated. Given that BendDAO is exposed to other NFT projects like CryptoPunks and Doodles, DoubleQ claims that these liquidations might result in “a death spiral for the BAYC ecosystem and NFT market as a whole.”

The analyst added, “OpenSea volume is at the lowest point ever in the last 12 months. There’s simply not enough volume to save these liquidations. It’s inevitable.”

The upcoming BAYC liquidation may present a chance to purchase the NFTs for less money. However, due to a lack of arbitrage opportunities, Naimish Sanghvi, CEO of an Indian-based crypto news site, questions if there would be any purchasers.

Your bid has to be more than 95% of the floor value and higher than the debt amount,” explained Sanghvi, noting that there could be no room for making money from arbitrage between these values.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.