- Binance CEO tagged a report by Bloomberg as ‘poop journalism.’

- Bloomberg reported that Binance’s reserves comprised primarily of an owned token, BUSD.

- CEO Zhao said its exchange is not the issuer of BUSD, and the tokens remain in the form its user sent them.

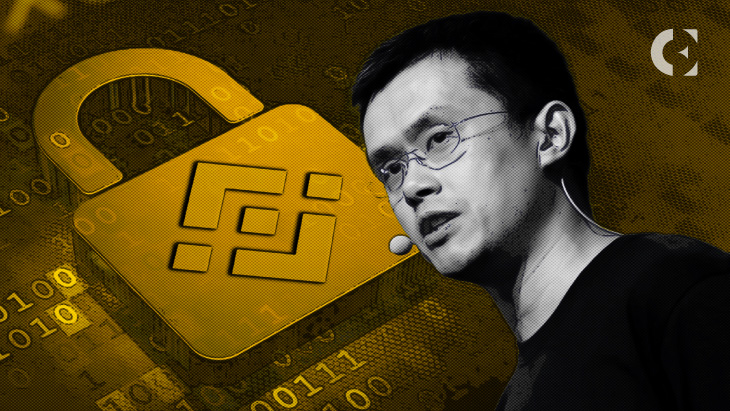

Changpeng Zhao (CZ), the CEO of the largest crypto exchange Binance has called out Bloomberg, one of the prominent media agencies in the United States, for publishing fake news about his business.

Based on supposedly reliable data, Bloomberg reported that Binance’s reserves comprised primarily of an owned token, BUSD, the third largest stablecoin. CEO Zhao described the write-up as ‘poop journalism,’ clarifying that its exchange is not the issuer of BUSD. Instead, the third-party company Paxos, under the regulation of NYDFS, had been in charge of the BUSD issuance.

Additionally, CZ said the BUSD tokens under Binance’s watch remain in the form its customers sent them without conversion. Interestingly, Bloomberg has taken down the erroneous news story.

Furthermore, a crypto FUD monger alleged that the Bitcoin-lover country El Salvador could have been exposed to the embattled FTX exchange. However, Binance CEO telephoned El Salvador’s president for confirmation, and the president established that the country never had any business dealings with FTX.

Given the recent insolvency case of FTX, the second-largest crypto marketplace until its bankruptcy, Binance published the balances of its cold wallet addresses for transparency purposes. The exchange controls 475k units of Bitcoin, 4.8 million Ethereum tokens, 21.7 billion BUSD, and other over 590 coins.

Other popular crypto exchanges like Coinbase and KuCoin have also published details of their cold wallet balances. Last Wednesday, CZ advised the crypto community that asset brokers should avoid using tokens they create as collateral.

Notably, Binance took a financial decision to liquidate its FTX token after an investigative report revealed that FTX’s balance sheet primarily contains FTT tokens rather than independent assets like a fiat currency.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.