- Binance’s CYBER futures listing sparks a bullish surge, but resistance looms at $4.72.

- Decreasing buying pressure threatens CYBER’s bullish momentum despite the initial wave.

- Technical indicators hint at a possible bearish trend reversal for CYBER’s recent rally.

Binance‘s recent announcement of listing CyberConnect (CYBER) futures trading, available at 20x leverage, has fueled a bullish surge in the cryptocurrency. As a result, the price of CYBER rocketed from an intra-day low of $4.14 to a 24-hour high of $4.72 before facing resistance.

CYBER token at press time was priced at $4.44, reflecting a 2.07% decrease from its intra-day high. The move to introduce CYBER futures trading on Binance has reignited investor optimism, resulting in a surge in buying pressure.

As the bull rally took shape, CYBER’s market capitalization and 24-hour trading volume surged by 6.56% and 44.09%, respectively, reaching $48,911,701 and $55,057,838. Should the bullish momentum breach the $4.72 resistance, we could see a move toward the next resistance level, around $5.00. On the other hand, a failure to break through this resistance may lead to a potential pullback to the support level at $4.20.

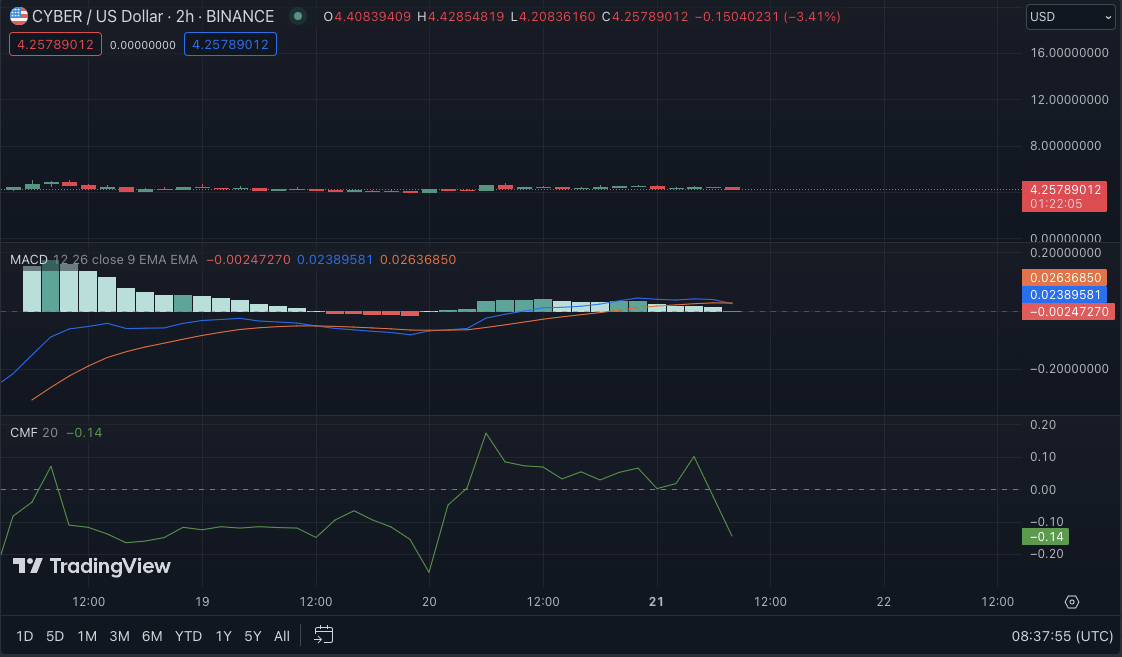

Significantly, the Moving Average Convergence Divergence (MACD) trend, with a positive reading of 0.03579145, indicates a bullish signal. This trend suggests strength in the current upward momentum of CYBER’s price.

However, the histogram’s shorter bars could potentially decrease bullish momentum. If the MACD line crosses below the signal line, it could signal a bearish reversal, suggesting that the upward momentum may weaken and a pullback or trend reversal may be imminent.

Moreover, the Chaikin Money Flow (CMF) is moving south with a reading of -0.14, indicating decreasing buying pressure. This trend further supports the idea of a potential decrease in bullish momentum and a possible shift in direction. If the CMF continues to decline and reaches a more pessimistic reading, it could indicate a more substantial decrease in buying pressure and a higher likelihood of a bearish trend taking over.

Moreover, on the CYBER/USD 2-hour price chart, the Aroon up sits at 14.29%, while the Aroon down touches 7.14%, suggesting a potential lack of upward momentum. If the Aroon down surpasses the Aroon up, it would reinforce bearish market sentiment and increase the probability of prices moving downward.

The Stochastic RSI rating of 34.85, now moving below its signal line, further supports the possibility of a downward price movement. As the market is currently slightly oversold, further selling pressure and a price decline could be expected. If the Stochastic RSI continues to decrease and falls below the oversold threshold of 20, it would suggest intensifying selling pressure and an increased likelihood of a significant price decline.

In conclusion, while the announcement of CYBER futures trading on Binance initially sparked optimism and a bullish surge, the decreasing buying pressure and various technical indicators suggest that the current trend may be at risk of reversing.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.