- BNB’s price decreased following withdrawal issues with Binance in Europe.

- The 9-day EMA crossed below the 20-day EMA, indicating increasing downward pressure.

- BNB’s next target could be around $205 if demand continues to wane.

Recent developments and market sentiment have created an atmosphere of uncertainty around Binance Coin (BNB), with distrust for the exchange Binance, being the likely reason. Lately, Binance has been subject to regulatory scrutiny. Furthermore, some of its abrupt decisions have left investors wondering if the exchange is still as solid as it claimed.

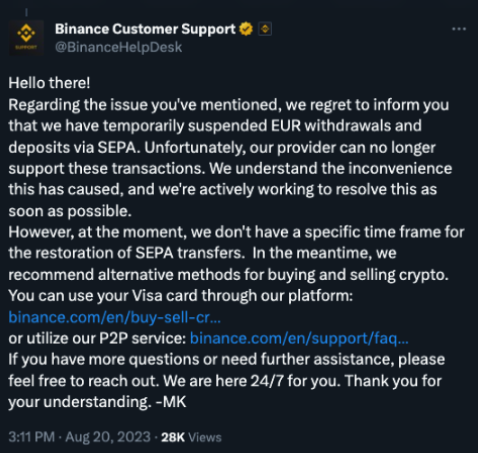

One issue that prompted the broader market to question Binance’s transparency was its decision to limit withdrawals in Europe. Binance, in a now-deleted post on X (formerly Twitter), disclosed that it had paused deposits and withdrawals in Europe.

No Demand for BNB Yet

Explaining the reasons for its decision, the exchange said it was having issues with its payment provider. Although Binance has now said deposits and transactions were back on, BNB has been severely affected by the earlier communiqué.

According to CoinMarketCap, BNB’s price was $209.98. The coin reached this price because selling pressure ensured that it lost 12.31% of its value in the last seven days. From the 4-hour chart, BNB’s market structure has been bearish since August 14.

Also, the Exponential Moving Average (EMA) revealed that BNB may not be far off from hitting $200. At the time of writing, the 9-day EMA (blue) was below the 20-day EMA (yellow). Whenever the 20 EMA crosses above the 9 EMA, it means the price action is bearish.

So, if any form of market demand doesn’t appear for BNB, the price may drop slowly from $205 to probably $195. However, the Moving Average Convergence Divergence (MACD) was 0.1. A positive MACD implies increasing upward momentum.

But both the blue dynamic line of the MACD and the orange line were below the zero mid-point. Basically, this is a sell signal, and traders may profit from opening BNB short positions.

Bears’ Season to Thrive?

Interestingly, information from the derivatives portal Coinglass showed that BNB’s funding rate had dropped into the negative area. Funding rates are payments made to either long or short traders based on the difference between spot and perpetual prices.

When the funding rate is positive, it means that longs are willing to pay shorts, and traders’ sentiment is largely bullish. But in BNB’s case, the negative funding rate suggests that traders are bearish on the BNB price action.

In conclusion, BNB hovering precariously around the $209 mark may not last long. If the FUD around Binance continues, and selling pressure intensifies, BNB may drop below $200.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.