- Changpeng Zhao stepped down as Binance CEO, pleading guilty to breaching anti-money laundering laws.

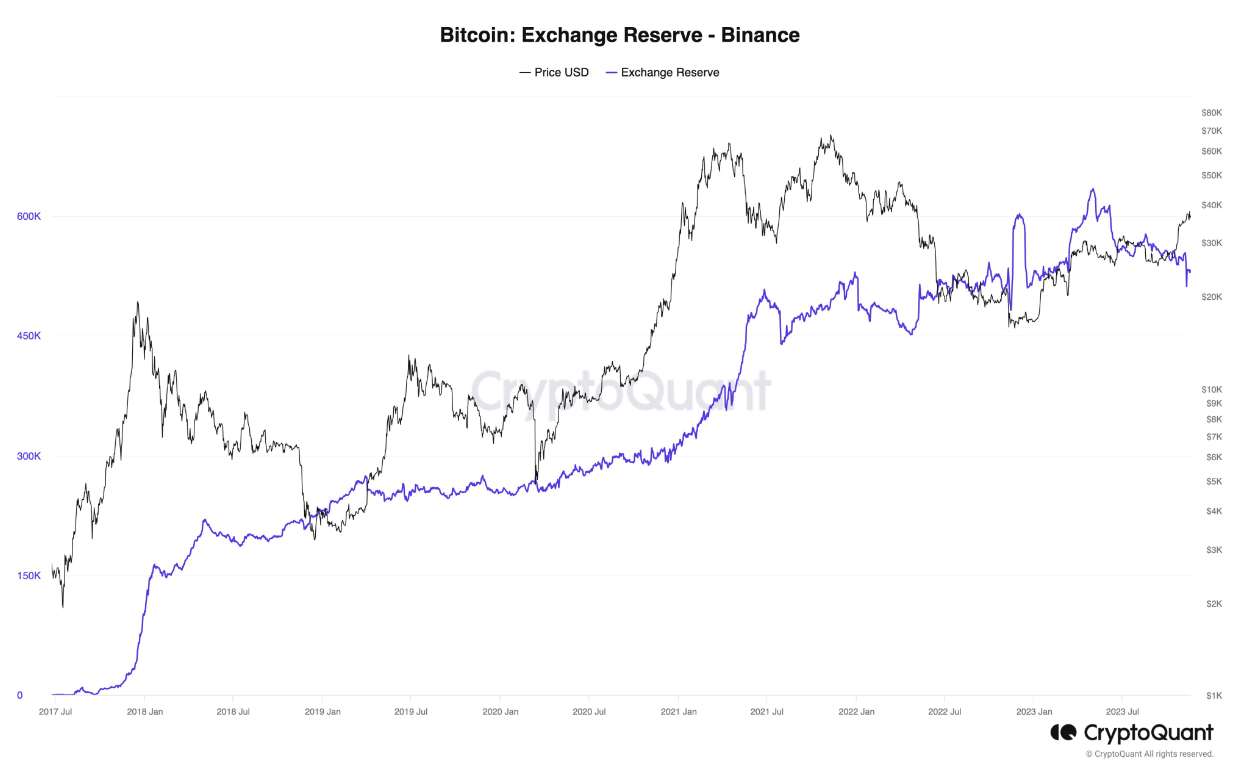

- Binance saw a liquidity crisis and a major outflow of assets following Zhao’s move.

- Despite these challenges, Binance leads as non-US users are less involved in the asset outflow.

Binance continues to linger at the forefront of the blockchain industry despite the ongoing regulatory pressures and Changpeng Zhao’s resignation. According to a recent CryptoQuant report, non-US users of Binance are less likely to withdraw their holdings on the platform.

Over the past few months, Binance and its CEO, Changpeng Zhao, have been sued by the US Securities and Exchange Commission (SEC), alleging that the platform breached federal securities laws. In a lawsuit filed by the SEC in June 2023, Binance was accused of operating unregistered exchanges, broker-dealers, and clearing agencies. In addition, the regulators accused Zhao of “misrepresenting trading controls and oversight on the Binance US platform,” along with facilitating the unregistered sale of securities.

In a recent turn of events, Zhao declared his departure from the firm, pleading guilty to breaching the anti-money laundering laws as part of a $4.3 billion settlement. Subsequently, Binance will be led by the former Global Head of Regional Markets, Richard Teng, who will take charge as the new CEO of the platform.

While Zhao admitted his mistakes via an X (formerly Twitter) thread, he also agreed with the court to pay $50 million from his personal holdings. Attorney General Merrick B. Garland shared his comments on the matter, asserting,

Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed; now it is paying one of the largest corporate penalties in U.S. history.

Consequently, as per a Bloomberg report, Binance witnessed a substantial outflow of its native token, BNB, and other cryptocurrencies. AltTab Capital’s Co-Founder Greg Moritz, cited, “The market has responded negatively in the short term to the Binance news.”

Despite these prevailing dilemmas, Binance maintains its lead with increasing exchange reserves. In terms of liquidity, Binance shows resilience; as Kaiko analyst pointed out, “There was an initial reaction to the news where liquidity dropped 40%, but in the past hour, liquidity has shown signs of returning to normal.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.